Introduction

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds and their managers. This time, Fidelity presents its three multi-asset fund ranges; Multi Asset Open, which favours active funds and tactically allocates assets depending on where its managers see the best investment opportunities; Multi Asset Income, which adopts a flexible approach to income generation; and Multi Asset Allocator, which offers investors a cost-efficient means to access global markets through passive instruments. Find out more in our profile and Q&A with their Portfolio Managers and CIO James Bateman plus supporting analysis from Citywire.

Introduction

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds and their managers. This time, Fidelity presents its three multi-asset fund ranges; Multi Asset Open, which favours active funds and tactically allocates assets depending on where its managers see the best investment opportunities; Multi Asset Income, which adopts a flexible approach to income generation; and Multi Asset Allocator, which offers investors a cost-efficient means to access global markets through passive instruments. Find out more in our profile and Q&A with their Portfolio Managers and CIO James Bateman plus supporting analysis from Citywire.

FIDELITY’S MULTI ASSET TEAM

FIDELITY’S MULTI ASSET TEAM

Dare to be different:

how dynamic allocation and contrarian calls have paid off

Dare to be different:

how dynamic allocation and contrarian calls have paid off

The rollercoaster ride for investment markets has been keeping Fidelity’s multi asset team on its toes. Its Multi Asset Open range was almost 10% underweight stock markets relative to peers amid the severe sell-off in the fourth quarter of last year, before buying back in ahead of the rebound at the beginning of 2019.

‘It’s been a most extraordinary three months for markets,’ said Bill McQuaker, who took over management of the five risk-rated funds at the start of 2017, joining Fidelity from Henderson Global Investors (as it was then), where he was head of multi asset, the previous year.

‘I’m not arguing for a moment that we saw this dramatic rally unfolding, but as prices changed through December and into the very first part of January we thought our concerns had been discounted in asset markets so we moved to a much more neutral position.

‘As we stand today, we’ve again been trading to a degree against the prevailing momentum in markets. As markets have rallied through February, we’ve begun to chip away at our equity exposure and I expect we’ll become more negative on the asset class in the next six months.’

The five-strong Multi Asset Open range consists of the Multi Asset Open Defensive, Multi Asset Open Strategic, Multi Asset Open Growth, Multi Asset Open Adventurous and Open World funds. Each has a specific annual return target ranging from 4% for Defensive to 7% for Open World. The other three target returns of 5%, 5.5% and 6.5% respectively.

In seeking to achieve these aims, each fund invests in a variety of asset classes, which are divided into three groups – growth, diversifying and hedging. These groups are based on the risk and return characteristics of asset classes, which the portfolio managers combine flexibly to deliver the objectives through time. For example, the most differentiating aspect of the allocation to hedging assets at the moment is exposure to gold and gold miners, which collectively command as much as 10%.

The team expects this part of the portfolio to outperform in at least two scenarios: one, if the global economy slows and real interest rates around the world meaningfully fall (its central scenario) and two, the economy proves in better shape than people think and inflation picks up (a scenario that it deems of low probability, but one it cannot completely discount).

Bill McQuaker and Ayesha Akbar, Portfolio Managers, Fidelity Multi Asset Open range

‘Any good diversified portfolio should have an element that is about generating high and meaningful positive rates of return, but there should also be part of the portfolio that is there to provide ballast through those periods where markets perform less well,’ said McQuaker.

‘Alongside gold, we’ve got some exposure to currencies that typically do well [in tougher times] – the Japanese Yen – to volatility and to more conventional duration assets, all of which should either mark time or possibly generate some reasonable rates of return over the next six months in the event of our central scenario.’

‘As markets have rallied… we’ve begun to chip away at our equity exposure and I expect we’ll become more negative on the asset class in the next six months’

Bill McQuaker

The team has the least exposure to high yield and emerging market debt, where McQuaker describes its appetite as ‘limited’.

‘What unfolded last December is really what keeps us away from those assets,’ he said. ‘If investors become fearful about the economic cycle turning down, if we see more volatility, then I think the potential liquidity concerns that characterise much of this part of the market could be a problem and I don’t think investors have been paid properly for these risks; the cycle risk and the credit risk they’re running.’

McQuaker and fellow multi asset portfolio manager Ayesha Akbar are key decision-makers on the Open range, but they draw on views from across Fidelity as inputs.

The team’s asset allocation discussions with colleagues from across Fidelity take place in weekly and monthly meetings, but the strategy is more fluid than that. ‘I would contend that we are discussing the issues at hand in a more informal manner on a daily basis,’ said McQuaker. ‘It’s a live conversation, which recognises the forces that change asset prices are constantly evolving.’

The Fidelity Multi Asset Income range takes a similarly dynamic approach to asset allocation. These funds are designed to deliver a natural income of 4-6% per year, and portfolio manager Eugene Philalithis argues that this requires a high degree of flexibility. He adds that portfolio positioning tends to be adjusted gradually and incrementally as market conditions change, and the team cautions against knee-jerk reactions or positioning around binary events.

The Fidelity Multi Asset Allocator funds are designed to be much less dynamic. Like the Open range, they map on to different levels of risk appetite but fundamentally differ in their avoidance of tactical asset allocation and commitment to passive strategies.

Portfolio manager Chris Forgan said: ‘This range of funds is about building the most optimal blended portfolios for clients and implementing those in a cost-efficient manner. So they’re 100% passive portfolios built around a strategic asset allocation that does not change; we’re not taking active asset allocation bets. All we do on a monthly basis is rebalance.’

Chris Forgan, Multi Asset Allocator range

Eugene Philalithis, Multi Asset Income range

The Allocator funds cost clients a flat 25 basis points. The Open funds, given their focus on active management, are more expensive, but have achieved economies of scale following the merger last month [March 2019] of Fidelity’s Multi Asset range with the Open range. The funds now cost between 100 and 120 basis points.

For that, investors get a depth of resource that Akbar believes is second to none in the industry.

James Bateman, Chief Investment Officer – Multi Asset

‘We’re trying to add value from a number of different sources,’ she said. ‘We’ve got three people in the team who do nothing but look for interesting ideas from an asset allocation perspective. Should we be investing in India or other emerging markets such as Latin America? Or should we be looking at commodities or MLP [Master Limited Partnership] funds?

‘We’ve got nine people focused on fund research and that’s not just active funds; it’s also passive funds. It’s a very dynamic approach; we are looking for the best ideas as and when they turn up, but you can’t really do that unless you have people supporting the effort.’

The manager of managers structure, which Fidelity’s multi asset business moved to in the autumn last year, is another key benefit to clients.

‘By leveraging Fidelity’s scale and long-term relationships with a wide range of active managers we have been able to negotiate exclusive and attractive commercial terms with our preferred providers,’ said James Bateman, chief investment officer of Fidelity’s multi-asset team.

‘The broader universe from which we can now select managers allows us to make those mangers we consider best-in-class available to our clients. Many active managers based in the US and Japan, for example, will not have structures available for international investors. The manager of managers structure allows us to access these managers efficiently.’

SECTOR

OVERVIEW:

MUlti asset

frank talbot

Head of Investment Research, CITYWIRE

SECTOR OVERVIEW:

ASIAN FIXED INCOME

frank talbot

Head of Investment Research, CITYWIRE

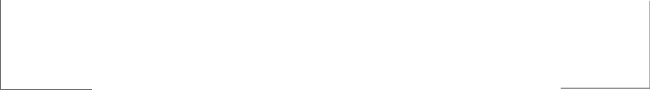

Fidelity Open World

The Fidelity Open World strategy is ahead of the average lipper global fund over one, three and five year time frames and since its launch in February 2013 when Ayesha Akbar started managing the portfolio. However, it has lagged it’s index over that time. This isn’t uncommon in this category in the post credit crisis period, with outperformance rates of just 17% over the past five years worldwide.

FIDELITY MULTI ASSET INCOME FUND

Philalithis has consistently outperformed the peer group average since taking on management of the Fidelity Multi Asset Income fund in April 2013. The manager has generated top decile risk adjusted and total returns in the peer group over all time frames from six months to five years.

Philalithis has been the strongest manager in the Mixed Asset – Conservative GBP peer group over both five and one year time frames on a risk-adjusted basis. This is clearly visible from his position in the upper most right hand quadrant of the bubble chart. In the process Philalithis has comfortably offered a better risk reward than the market share leader and Standard Life Investments, who controls nearly a quarter of the sectors assets.

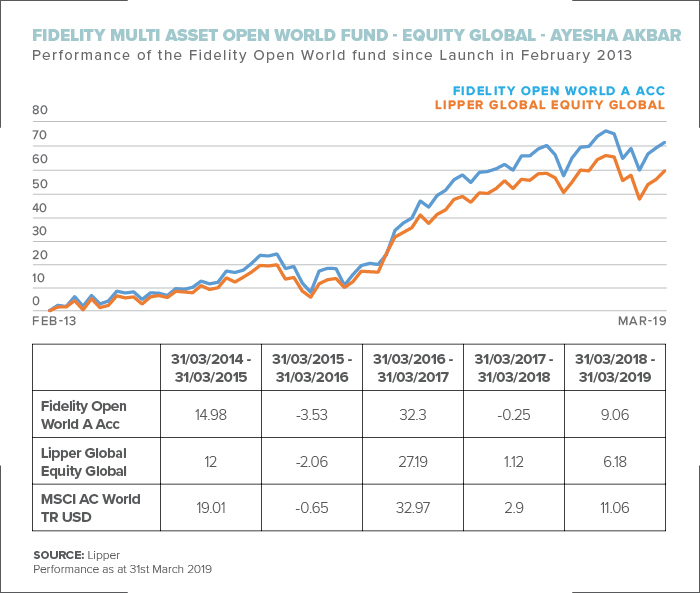

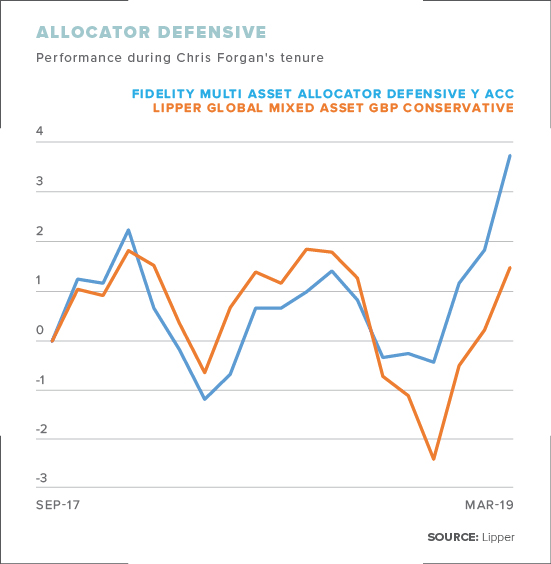

Since taking over management of the Fidelity Allocator series of funds in October 2017, Chris Forgan has outperformed the Lipper peer group average on all five funds.

FUND MANAGER HOT-SEAT: STANDING OUT FROM THE CROWD

FUND MANAGER HOT-SEAT: STANDING OUT FROM THE CROWD

In recent years THE MULTI ASSET SECTOR HAS GROWN EXPONENTIALLY. WHAT SETS YOUR FUNDS APART?

Portfolio manager Ayesha Akbar: Bill [McQuaker] is an incredibly experienced multi asset manager; he’s got a fantastic track record from his previous companies and he’s brought all of that experience to Fidelity. What he has here that perhaps he didn’t have at other places is the number of people behind the whole process. There’s an awful lot going on and a phenomenal resource that we can draw upon.

Portfolio manager Chris Forgan: The global nature of what we’ve built differentiates us from peers. While some funds might have a home bias, ours are truly global in nature. Our open architecture approach also gives us an edge. We’re not wedded to one particular house in terms of implementing active or passive strategies. It’s about going out and finding the best instruments in the marketplace with which to express our views.

HOW DOES THE INVESTMENT APPROACH DIFFER ACROSS THE THREE RANGES?

Forgan: The Multi Asset Allocator funds are passive multi asset products that are built to deliver what we believe to be an optimal blend for a particular risk and return profile. They’re built around a strategic asset allocation and differ from the other funds you are talking to us about, which look to take asset allocation decisions and generate alpha from underlying managers.

McQuaker: [In running the Multi Asset Open funds], we spend quite a lot of time on asset allocation. We are interested in how the economic cycle unfolds. We believe that policy, in particular monetary policy, is important for markets. One way to think about the drivers of asset prices is in an absolute sense – the global economic cycle, global policy settings and how markets’ existing flows are in aggregate – but we also consider the relative attractions of different regions around the world. Does the economic cycle favour emerging markets? Does policy lead us to favour the US? Where are investors most and least exposed in such a way that a change in circumstances would cause them to do something to their portfolio? We pay quite a lot of attention to how other people in this industry have positioned their portfolios, because those insights can be quite helpful from a timing perspective.

Portfolio manager Eugene Philalithis: The Multi Asset Income funds target a yield of between 4% and 6%. That’s our primary objective, but we also have secondary objectives of capital preservation and low volatility. We believe that diversifying sources of income and having a global opportunity set really increase our chances of achieving those outcomes. We focus on generating natural income – income from bonds, dividends from equities and so forth – as the most sustainable way of delivering strong, long-term income.

HOW DO YOU GO ABOUT IMPLEMENTING YOUR VIEWS?

Akbar: We have a dedicated implementation team, with extensive experience in trading multi asset portfolios which a lot of our peers don’t have. We work very closely with them to make sure we’re implementing all of the fantastic ideas that we’re getting from the team in the most efficient way possible.

McQuaker: We have a carefully thought out and well-resourced approach to selecting individual assets to implement ideas, and then portfolio construction is about how to bring those ideas together in a way that delivers the combined effect that different types of clients are looking for. It’s important that each of our portfolios has a distinct character that is consistent through the entire economic cycle. So, if you buy a strategy that is low risk, even in an environment where we really like the equity market, that portfolio should still have quite low exposure to equities and the same at the other end of the spectrum.

HOW MUCH COURAGE DO YOU HAVE IN YOUR CONVICTIONS?

McQuaker: We tend to look at funds relative to peer group averages and looking back over the past two years when we’ve been optimistic about equities we [the Open funds] have been up to 5% overweight. When we’ve been more cautious on equities – as in the fourth quarter of 2018 when we were quite conscious of equity market valuations – we’ve been not far short of 10% underweight. So I think we express with some confidence our near term tactical views. If I look at other funds, you sometimes see managers where, regardless of how bullish or bearish they are, there’s not a great deal of deviation away from long-term average weightings. I don’t think we’re in that category. We’re arguably a bit more ambitious than that.

Chris Forgan, Portfolio Manager, Fidelity Multi Asset Allocator range

Philalithis: We don’t follow a benchmark and have very broad limits in terms of the different asset classes we can use – traditional ones like equities and bonds, alongside non-traditional ones like infrastructure and renewable energy. We are highly diversified in order to achieve our low volatility objective. As an example, one of our income funds employs 49 different strategies and 43 underlying portfolio managers.

THAT LEVEL OF FLEXIBILITY MUST BE VERY IMPORTANT FOR A MULTI-ASSET STRATEGY…

Philalithis: Absolutely. Being multi asset, we can look at asset classes as a continuum across the spectrum, rather than separately. We have the ability to pick the best places to invest. We take all of the input that we get from across our team – in terms of macroeconomics, the manager views, our own markets research, as well as bottom-up information from Fidelity’s equity and fixed income managers. We can then use all of that to say: ‘Okay, we particularly like Asia at the moment and within Asia we like Asia high yield [bonds].’ That’s where we have one of our high conviction positions at the moment in terms of both income generation but also the potential for upside.

Eugene Philalithis, Portfolio Manager, Fidelity Multi Asset Income range

HOW IS YOUR MULTI-ASSET TEAM STRUCTURED?

Multi Asset CIO James Bateman: The biggest strength of our team is its experience – we’ve assembled a diverse team of people from different backgrounds and that breadth of experience is brought together to deliver better outcomes for our clients. Our team is structured to ensure specialist coverage across key areas and disciplines from idea generation to portfolio construction. From these areas of specialism, the team collaborates closely to exchange, debate and challenge views, which we believe is a critical part of any multi-asset investment process. Risk management is central to all investment decisions and is integral to the ongoing monitoring of the portfolios.

HOW ARE ADVISERS USING YOUR FUNDS?

Philalithis: We’ve seen the [Fidelity Multi Asset] Income fund being used as an income replacement strategy especially in more defensive portfolios. Investors who are looking for a proposition that can offer both growing distributions over time and the potential for capital growth might look at [Fidelity Multi Asset] Balanced Income or [Fidelity Multi Asset] Income & Growth, which are the second and third funds in the range. We’ve had some very good returns from markets over the last few years and looking forward, the prospects for future returns might be reduced. If you have a solution that can give you an attractive level of income as part of a total return proposition and some focus on capital preservation, then that gives you a good core component. I think we’ve had more people using the fund like that as well.

Forgan: The Allocator funds have been built to provide a smoother client experience – they aim to minimise volatility and drawdowns, and maximise returns for a particular level of risk. The strategic asset allocation nature of these funds means they map strongly to clients’ risk profiles. By delivering diversified, off-the-shelf exposure to the two big asset classes – equities and bonds – they can effectively become the core of a client’s portfolio.

IMPORTANT INFORMATION

The value of investments and the income from them can go down as well as up, so you may not get back what you invest. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The Fidelity Multi Asset funds use financial derivative instruments for investment purposes, which may expose the fund to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Overseas investments will be affected by movements in currency exchange rates. The price of bonds is influenced by movements in interest rates, changes in the credit rating of bond issuers, and other factors such as inflation and market dynamics. In general, as interest rates rise the price of a bond will fall. The risk of default is based on the issuer’s ability to make interest payments and to repay the loan at maturity. Default risk may, therefore, vary between different government issuers as well as between different corporate issuers. Liquidity is a measure of how easily an investment can be converted into cash. It is possible that, in difficult market conditions, it could be hard to sell holdings in corporate bond funds. Investments in emerging markets can be more volatile than other more developed markets. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. This article may not be reproduced or circulated without prior permission. Issue d by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0319/23831/SSO/NA

CITYWIRE INVESTMENT WARNING

This communication is by Citywire Financial Publishers Ltd (“Citywire”) and is provided in Citywire’s capacity as financial journalists for general information and news purposes only. It is not (and is not intended to be) any form of advice, recommendation, representation, endorsement or arrangement by Citywire or an invitation to invest or an offer to buy, sell, underwrite or subscribe for any particular investment. In particular, the information provided will not address your particular circumstances, objectives and attitude towards risk.

Any opinions expressed by Citywire or its staff do not constitute a personal recommendation to you to buy, sell, underwrite or subscribe for any particular investment and should not be relied upon when making (or refraining from making) any investment decisions. In particular, the information and opinions provided by Citywire do not take into account your personal circumstances, objectives and attitude towards risk.

Citywire uses information obtained primarily from sources believed to be reliable (such as company reports and financial reporting services) however Citywire cannot guarantee the accuracy of information provided, or that the information will be up-to-date or free from errors. Investors and prospective investors should not rely on any information or data provided by Citywire but should satisfy themselves of the accuracy and timeliness of any information or data before engaging in any investment activity. If in doubt about a particular investment decision an investor should consult a regulated investment advisor who specialises in that particular sector.

Information includes but is not restricted to any video, article or guide content created or provided by Citywire.

For your information we would like to draw your attention to the following general investment warnings:

The price of shares and investments and the income associated with them can go down as well as up, and investors may not get back the amount they invested. The spread between the bid and offer prices of securities can be significant in volatile market conditions, especially for smaller companies. Realisation of small investments may be relatively costly. Some investments are not suitable for unsophisticated or non-professional investors. Appropriate independent advice should be obtained before making any such decision to buy, sell, underwrite or subscribe for any investment and should take into account your circumstances and attitude to risk.

Past performance is not necessarily a guide to future performance. Citywire Financial Publishers Ltd. is authorised and regulated by the Financial Conduct Authority (no: 222178).

TERMS OF SERVICE

Citywire Source is owned and operated by Citywire Financial Publishers Ltd (“Citywire”). Citywire is a company registered in England and Wales (company number 3828440), with registered office at 1st Floor, 87 Vauxhall Walk, London, SE11 5HJ and is authorised and regulated by the Financial Conduct Authority (no: 222178) to provide investment advice and is bound by its rules.

1. Intellectual Property Rights 1.1 We are the owner or licensee of all copyright, trademarks and other intellectual property rights in and to these works (including all information, data and graphics in them) (collectively referred to as “Content”). You acknowledge and agree that all copyright, trademarks and other intellectual property rights in this Content shall remain at all times vested in Citywire and /or its licensors. 1.2 This Content is protected by copyright laws and treaties around the world. All such rights are reserved. Images and videos used on our websites are © iStockphoto, Alamy, Thinkstock, Topfoto, Getty Images or Rex Features (among others). For credit information relating to specific images where not stated, please contact picturedesk@citywire.co.uk. 1.3 You must not copy, reproduce, modify, create derivative works from, transmit, distribute, publish, summarise, adapt, paraphrase or otherwise publicly display any Content without the specific written consent of a director of Citywire. This includes, but is not limited to, the use of Citywire content for any form of news aggregation service or for inclusion in services which summarise articles, the copying of any Fund manager data (career histories, profile, ratings, rankings etc) either manually or by automated means (“scraping”). Under no circumstance is Citywire content to be used in any commercial service.

2. Non-reliance 2.1 You agree that you are responsible for your own investment decisions and that you are responsible for assessing the suitability and accuracy of all information and for obtaining your own advice thereon. You recognise that any information given in this Content is not related to your particular circumstances. Circumstances vary and you should seek your own advice on the suitability to them of any investment or investment technique that may be mentioned. 2.2 The Fund manager performance analyses and ratings provided in this Content are the opinions of Citywire as at the date they are expressed and are not recommendations to purchase, hold or sell any investment or to make any investment decisions. Citywire’s opinions and analyses do not address the suitability of any investment for any specific purposes or requirements and should not be relied upon as the basis for any investment decision. 2.3 Persons who do not have professional experience in participating in unregulated collective investment schemes should not rely on material relating to such schemes. 2.4 Past performance of investments is not necessarily a guide to future performance. Prices of investments may fall as well as rise.

2.5 Persons associated with or employed by Citywire may hold positions or take positions in investments referred to in this publication. 2.6 Citywire Financial Publishers Ltd operate a policy of independence in relation to matters where the operators may have a material interest or conflict of interest.

3. Limited Warranty 3.1 Neither Citywire nor its employees assume any responsibility or liability for the accuracy or completeness of the information contained on our site. 3.2 You acknowledge and agree that any information that you receive through use of the site is provided “as is” and “as available” basis without representation or endorsement of any kind and is obtained at your own risk. 3.3 To the maximum extent permitted by law, Citywire excludes all representations, warranties, conditions or other terms, whether express or implied (by statute, common law, collaterally or otherwise) in relation to the site or otherwise in relation to any Content or Feed, including without limitation as to satisfactory quality, fitness for particular purpose, non-infringement, compatibility, accuracy, or completeness. 3.4 Notwithstanding any other provision in these Terms, nothing herein shall limit your rights as a consumer under English law.

4. Limitation of Liability To the maximum extent permitted by law, Citywire will not be liable in contract, tort (including negligence) or otherwise for any liability, damage or loss (whether direct, indirect, consequential, special or otherwise) incurred or suffered by you or any third party in connection with this Content, or in connection with the use, or results of the use of Content. Citywire does not limit liability for fraudulent misrepresentation or for death or personal injury arising from Citywire’s negligence.

5. Jurisdiction These Terms are governed by and shall be construed in accordance with the laws of England and the English courts shall have exclusive jurisdiction in the event of any dispute in connection with this Content or these Terms.