Making more

of multi-asset

Presenting the HSBC Global Strategy Portfolios

Sponsored by

FEBRUARY 2020

Introduction

Welcome to another edition of SOURCE, a publication that shines the spotlight on particular funds and their managers. This time, Ashley Reid and Will Thompson of HSBC present the HSBC Global Strategy portfolios with an in-depth profile and Q&A, plus supporting analysis from Citywire.

Introduction

Welcome to another edition of SOURCE, a publication that shines the spotlight on particular funds and their managers. This time, Ashley Reid and Will Thompson of HSBC present the HSBC Global Strategy portfolios

with an in-depth profile and Q&A, plus supporting analysis from Citywire.

Avoiding set-and-forget:

exploiting opportunities via asset allocation

Avoiding

set-and-forget:

exploiting opportunities via asset allocation

It can be hard for managers to keep their heads when the political and economic world around them is so uncertain. The UK’s withdrawal from the EU, the US presidential elections, viral outbreaks and trade wars are just a handful of the unpredictable and hugely impactful events that have created recent market volatility. Yet, they must keep calm and carry on, as they live in a time when they are expected to take more responsibility than ever before for securing their clients’ financial futures.

‘Don’t put all of your eggs in one basket’ is the old adage for investors and it’s entirely pertinent today. Taking a long-term view and investing across a diversified set of asset classes, sectors and regions can cut through this external noise and provide some consistency

of return. In short, managers need to be able to move in and out of different sources of return as and when they look most beneficial.

But with such a huge range of asset classes spread across an increasingly interdependent world, making cost-effective investment choices with confidence is a challenge. It is no wonder then that global multi-asset strategies offering one-stop shop access to diversified funds have proved popular since the financial crash of 2008, when over exposure to single asset classes left many investors nursing burnt fingers.

Global reach

A global outlook is critical if managers are to achieve a truly diversified strategy, says Reid’s co-portfolio manager Will Thompson. ‘By investing globally, we are accessing the widest possible set of growth drivers. Taking a global approach should really be the default position.’

What’s more, by investing dynamically between geographies, managers can exploit opportunities as they arise and are not beholden to the market fortunes of any one jurisdiction. Thompson gives the UK stock market as an example. ‘It is easy to think that there’s something unique or potentially special about the UK market. Yes, some elements of the UK landscape are interesting from a valuation perspective right now, but we can still take advantage of those discounts as and when they open up just by being global,’ he says.

However, global exposure is only

of use if managers can move between regions quickly and efficiently. ‘The set-and-forget approach to strategic asset allocation is not the right way. It is important for multi-asst managers to be flexible,’ Reid says.

At the same time, there must be a clearly defined investment process to manage risk and ensure opportunities are not missed. Reid says investors need to know the parameters in which their fund managers operate.

He adds: ‘It’s a balancing act between a structured, disciplined, well thought through approach while having the

ability to adapt to conditions as they arise within that process, and demonstrating a dynamic mindset.’

‘By investing globally, we are accessing the widest possible set of growth drivers.

A global approach should really be the default position’

Will Thompson

Importantly, this means that if there is a change in market conditions – a return to rising bond yields, for example – the multi-asset strategy must be able to capitalise. In this scenario, a structured framework should prevent fund managers from making knee-jerk reactions.

‘We think about the relative merits of different assets and recently that has kept us in equities, given that the underlying base of bond yields remains very low. But if markets change and liquidity returns, then it comes back to this point about flexibility. Our tactical agility means we can re-evaluate our asset allocation,’ Reid says.

Risk and return

It is not just the markets and the macro politics that are unpredictable; so too are individuals’ own experiences and as such their financial expectations. Multi-asset strategies are well placed to help meet a variety of risk return profiles and investors can move between funds as their circumstances change.

For example, the HSBC Global Strategy portfolios comprise of different asset weightings depending on the targeted return. The five portfolios scan from cautious at the lower risk end of the spectrum to adventurous at the other. Allocations to return-seeking assets increase as you move along the spectrum, while weightings to more defensive assets such as government bonds decrease.

‘The equity allocation within the five funds broadly varies from 20% up to 90% plus. Clients can invest depending on their risk tolerance knowing that they are going to get a consistently managed fund structure within that risk range,’ Reid says.

For today’s long-term investors, the ability to maintain diversification while managing their risk exposure is critical. If they are falling short of their desired income expectations, it is possible to ramp up returns while maintaining a diversified portfolio thanks to the multi-asset structure. Conversely, as investors near retirement, or they need to protect their funds and want to dial down risk, they can move to a more cautious multi-asset strategy.

Thompson says: ‘With our global strategies, we think about how a client’s risk preference should evolve as they mature and their needs change. That is one of the things a multi-asset fund range can do very easily for a client that perhaps other types of bond funds or equity funds don’t have the flexibility to do.’

SECTOR

OVERVIEW:

Mixed Asset

frank talbot

Head of Investment Research, CITYWIRE

SECTOR OVERVIEW:

Mixed Asset

frank talbot

Head of Investment Research, CITYWIRE

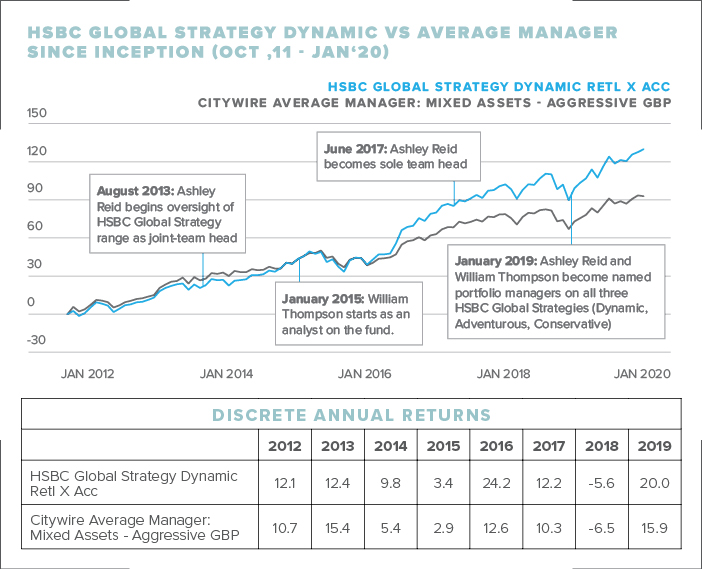

Since launch the HSBC Global Strategy Dynamic portfolio has only failed to outperform the average manager in the Citywire Mixed Assets – Aggressive GBP peer group in one calendar year. In the process it has generated annualised returns of 11.1% from the start of 2012 to the end of 2019. Moreover, during Ashley Reid‘s tenure as team head – August 2013 onwards – the portfolio has never failed to better the average manager in the peer group over a full calendar year, outperforming by an average of 3.9% per annum. The portfolio‘s outperformance has been significantly aided by the decision to overweight to US equities index funds, with the current allocation to US equities standing at 44% of the fund.

SOURCE: Citywire Discovery/Morningstar, as at 31.01.2020. Performance is based on total return in GBP calculated gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Average manager is based upon the managers tracked globally in Citywire‘s Mixed Assets – Aggressive GBP sector. Past performance is not an indication of future returns.

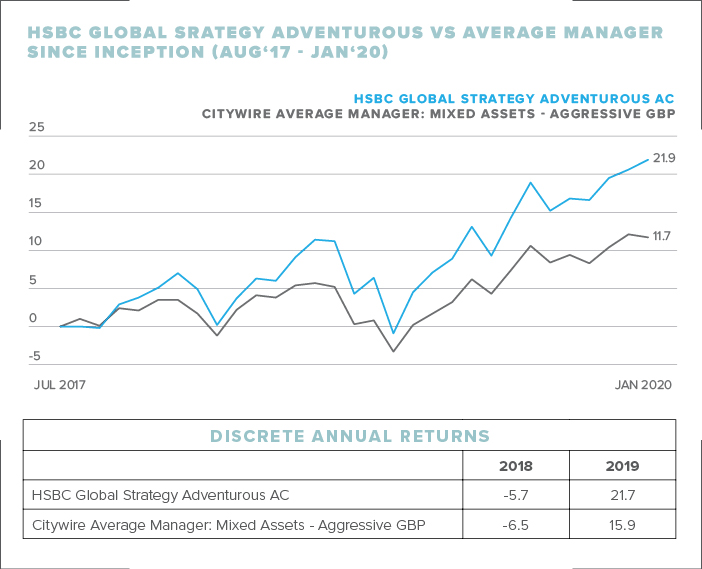

While not yet at their three year anniversaries, returns for both Adventurous and Conservative portfolios has been extremely strong. The adveturous portfolio has outperformed the average Mixed Assets – Aggressive GBP manager by 10.2%. At the same time the Conservative portfolio has nearly doubled the returns of the average Mixed Assets – Conservative GBP manager delivering 13.1% to investors compared the average‘s 7.4% gain.

SOURCE: Citywire Discovery/Morningstar, as at 31.01.2020. Performance is based on total return in GBP calculated gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Average manager is the based upon the managers tracked globally in Citywire‘s Mixed Assets – Aggressive GBP and Conservative GBP sectors. Past performance is not an indication of future returns.

SOURCE: Citywire Discovery/Morningstar, as at 31.01.2020. Performance is based on total return in GBP calculated gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Average manager is the based upon the managers tracked globally in Citywire‘s Mixed Assets – Aggressive GBP and Conservative GBP sectors. Past performance is not an indication of future returns.

FUND MANAGER HOT-SEAT

Q&A with Ashley Reid

and Will Thompson

FUND MANAGER

HOT-SEAT

Q&A with Ashley Reid and Will Thompson

What is the Global Strategy range designed to do?

Will Thompson: Our Global Strategy portfolios are a range of five risk-rated funds that provide access to government bond, equity, corporate bond and real-estate markets. The portfolios are designed to invest globally and dynamically. We believe asset allocation is the key driver of portfolio returns and should be implemented in a cost-efficient manner. What we offer, in short, is a truly multi-asset, globally diversified and actively managed portfolio that can navigate through different market conditions.

Can you talk us through your investment process and how your funds are differentiated?

WT: Traditional correlations across asset classes have faltered, and as such advisers have increasingly called on multi-asset specialists to provide dynamic asset allocation, selectivity, income and protection. We use beta market cap-based strategies to deliver on these requirements, which means our ideas are implemented at the lowest possible cost.

We also have an optimisation framework, which is essentially a methodology for tilting us towards asset classes that are more attractive on an expected-returns basis. Elsewhere, we review the political landscape and think about intrinsic value. By being tactical, we can take advantage of opportunities and shape the portfolio to be more adaptable than a 60/40.

Ashley Reid: Yes, adaptability is the key point. Our underlying investments are made using passive vehicles, but the allocations shift dynamically through time to reflect our market views. The process is structured, consistent and based on firm investment principles. This means we don’t have to rely on star managers to generate returns. Additionally, we are supported by the group’s global equity and fixed income teams and we have a multi-asset research forum for quantitative and qualitative input. So, we lean on the best of HSBC to meet the requirements of each fund in the range.

What is your level of exposure to certain investment themes and regions?

WT: It varies by risk profile. But if we have a regional equity idea, for example, we tilt towards that across all risk profiles. The weighting might be different across each portfolio, but aim to use that idea across the range.

Global growth is robust but this might change as growth across developed economies reverts to a mean level. So we are overweight emerging markets and developed markets excluding US.

We also have a position in US inflation-linked bonds. They provide a useful portfolio hedge at this point in the cycle and, to fund some of our equity overweights, we’re underweight credit.

The credit quality of the investment grade index has deteriorated over the past two years. For example, carry pickups for holding investment grade versus government bonds are still available, but we don’t think it is worth it. We’d rather take our risk to equities and be underweight global credit.

AR: It’s worth adding that our asset allocations are refreshed annually but the portfolios are not ‘set-and-forget’ – we express shorter-term tactical ideas when appropriate. This combination of longer-term valuation and shorter-term tactical activity is key for us.

We also incorporate environmental, social and governance (ESG) considerations into our investment process. We think this is a growing trend and have an expanding range of ESG and low-carbon focused funds.

Which instruments are providing the best opportunities at the moment?

WT: Our top-down, macro approach means we only invest in index funds or market-cap index trackers. We don’t ultimately delve into the company analysis because our tactical approach means we ask what impact the macroenvironment will have on the US stock market as a whole versus the European market. This speaks to the diversification value of multi-asset investing. We focus on the macro as much as we can. In our view, this is more predictable than single stock picking.

AR: Yes, getting the asset allocation right is key. Having spent twenty years as an equity portfolio manager and analyst, I know how difficult picking single stocks is as a fulltime equity manager. With this in mind, we focus on cross asset valuation, knowing that we want to invest as cost efficiently as possible. The things that provide dividends for investors are repeatability of process, consistency and visibility. Boring as it may sound, repeatability is the engine that sparks good outcomes for clients.

What is your market outlook?

WT: Our outlook for 2020 is that growth should be around trend. It doesn’t sound particularly exciting, but the market isn’t necessarily discounting trend growth. Trend could be a slightly positive outcome for markets, given the amount of fear and uncertainty that’s embedded in some of the market pricing.

I don’t think there’ll be an inflationary spike that will help central banks remain on hold. The issues around Iran and the coronavirus outbreak in January are things we can’t predict. But if we think about our themes, we’re slightly positive on risk assets. The market is expressly pessimistic and we’re climbing this geopolitical ‘wall of worry’ even while the fundamentals look relatively strong.

AR: If we look at the equity risk premium, it still looks attractive within a multi-asset context. The relative merits of different assets within that framework, as Thompson said, has kept us in equities and it continues to keep us in equities, given that the underlying base of bond yields remains very low.

We’re likely to get strong policy support from the US Federal Reserve and we’re also seeing a lot of liquidity in the Far East and China. We’re aware of these factors so we don’t just dive into markets. We evaluate a combination of factors – whether it’s liquidity or looking at real time macro information.

Overall the picture is positive. Our valuation discipline has led us to hold on to our equity allocations. But it comes back to this point about flexibility. If we do think things will change due to factors impacting global growth, then we will pivot. But we’re certainly not there yet.

Key risks

The HSBC Global Strategy Portfolios are monitored continuously by our investment managers to ensure the funds deliver to the aim of the funds as set out in the fund prospectus. The key types of risk associated with the HSBC Global Strategy Portfolios asset allocations are as follows (please refer to the KIID for the full list):The HSBC Global Strategy Portfolios are monitored continuously by our investment managers to ensure the funds deliver to the aim of the funds as set out in the fund prospectus. The key types of risk associated with the HSBC Global Strategy Portfolios asset allocations are as follows (please refer to the KIID for the full list):

1. Equity risks

Market fluctuations can affect the performance of an investment fund both upwards and downwards. You may not get back the full amount invested.

2. Emerging markets risk

Emerging economies typically exhibit higher levels of investment risk. Markets are not always well regulated or efficient and investments can be affected by reduced liquidity.

3. Exchange rate risk

Investing in assets denominated in a currency other than that of your own currency perspective exposes the value of the investment to exchange rate fluctuations.

4. Fixed income risk

As interest rates rise debt securities will fall in value. Issuers of debt securities may fail to meet their regular interest and/or capital repayment obligations. All credit instruments therefore have potential for default. Higher yielding securities are more likely to default.

5. Real estate risk

Cost of acquisition and disposal, taxation, planning, legal, compliance and other factors can materially impact real estate valuation.

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you may not receive back the amount originally invested.

IMPORTANT INFORMATION

For professional clients only and should not be distributed to or relied upon by retail clients.

The HSBC Global Strategy Portfolios are a sub-fund of HSBC OpenFunds, an Open Ended Investment Company that is authorised in the UK by the Financial Conduct Authority. The Authorised Corporate Director and Investment Manager is HSBC Global Asset Management (UK) Limited. All applications are made on the basis of the HSBC OpenFunds prospectus, Key Investor Information Document (KIID), Supplementary Information Document (SID) and most recent annual and semi annual report, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8, Canada Square, Canary Wharf, London, E14 5HQ, UK, or the local distributors. Investors and potential investors should read and note the risk warnings in the prospectus and relevant KIID and additionally, in the case of retail clients, the information contained in the supporting SID.

The material contained in this presentation is for information only and does not constitute investment advice or a recommendation to any recipient of this material to buy or sell investments. HSBC Global Asset Management (UK) Limited has based this presentation on information obtained from sources it believes to be reliable but which it has not independently verified. HSBC Global Asset Management (UK) Limited and HSBC Group accept no responsibility as to its accuracy or completeness. This presentation is intended for discussion only and shall not be capable of creating any contractual or other legal obligations on the part of HSBC Global Asset Management (UK) Limited or any other HSBC Group company. Care has been taken to ensure the accuracy of this presentation but HSBC Global Asset Management (UK) Limited accepts no responsibility for any errors or omissions contained therein. The views expressed here were held at the time of preparation and are subject to change.

Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target. Past performance should not be seen as an indication of future returns.

Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years.

Where charges are taken from capital, although this will enhance the income distributed, it may constrain the capital growth of your investment. If charges are taken from income, and there is insufficient income to meet such charges, any deficit will be taken from the capital. This could result in an erosion of the capital value of the investment. The level of yields are not guaranteed and may rise or fall in the future.

The information in this presentation is based on HSBC’s interpretation of current legislation and HM Revenue & Customs practice. While we believe that this interpretation is correct, we cannot guarantee it. Legislation and tax practice may change in the future. Tax treatment is based upon individual client circumstances.

This presentation is issued in the UK by HSBC Global Asset Management (UK) Limited which is authorised and regulated by the Financial Conduct Authority. Copyright HSBC Global Asset Management (UK) Limited 2020. All Rights Reserved.

Expiry date: 12/2020

www.assetmanagement.hsbc.com/uk

CITYWIRE INVESTMENT WARNING

This communication is by Citywire Financial Publishers Ltd (“Citywire”) and is provided in Citywire’s capacity as financial journalists for general information and news purposes only. It is not (and is not intended to be) any form of advice, recommendation, representation, endorsement or arrangement by Citywire or an invitation to invest or an offer to buy, sell, underwrite or subscribe for any particular investment. In particular, the information provided will not address your particular circumstances, objectives and attitude towards risk.

Any opinions expressed by Citywire or its staff do not constitute a personal recommendation to you to buy, sell, underwrite or subscribe for any particular investment and should not be relied upon when making (or refraining from making) any investment decisions. In particular, the information and opinions provided by Citywire do not take into account your personal circumstances, objectives and attitude towards risk.

Citywire uses information obtained primarily from sources believed to be reliable (such as company reports and financial reporting services) however Citywire cannot guarantee the accuracy of information provided, or that the information will be up-to-date or free from errors. Investors and prospective investors should not rely on any information or data provided by Citywire but should satisfy themselves of the accuracy and timeliness of any information or data before engaging in any investment activity. If in doubt about a particular investment decision an investor should consult a regulated investment advisor who specialises in that particular sector.

Information includes but is not restricted to any video, article or guide content created or provided by Citywire.

For your information we would like to draw your attention to the following general investment warnings:

The price of shares and investments and the income associated with them can go down as well as up, and investors may not get back the amount they invested. The spread between the bid and offer prices of securities can be significant in volatile market conditions, especially for smaller companies. Realisation of small investments may be relatively costly. Some investments are not suitable for unsophisticated or non-professional investors. Appropriate independent advice should be obtained before making any such decision to buy, sell, underwrite or subscribe for any investment and should take into account your circumstances and attitude to risk.

Past performance is not necessarily a guide to future performance. Citywire Financial Publishers Ltd. is authorised and regulated by the Financial Conduct Authority (no: 222178).

TERMS OF SERVICE

Citywire Source is owned and operated by Citywire Financial Publishers Ltd (“Citywire”). Citywire is a company registered in England and Wales (company number 3828440), with registered office at 1st Floor, 87 Vauxhall Walk, London, SE11 5HJ and is authorised and regulated by the Financial Conduct Authority (no: 222178) to provide investment advice and is bound by its rules.

1. Intellectual Property Rights 1.1 We are the owner or licensee of all copyright, trademarks and other intellectual property rights in and to these works (including all information, data and graphics in them) (collectively referred to as “Content”). You acknowledge and agree that all copyright, trademarks and other intellectual property rights in this Content shall remain at all times vested in Citywire and /or its licensors. 1.2 This Content is protected by copyright laws and treaties around the world. All such rights are reserved. Images and videos used on our websites are © iStockphoto, Alamy, Thinkstock, Topfoto, Getty Images or Rex Features (among others). For credit information relating to specific images where not stated, please contact picturedesk@citywire.co.uk. 1.3 You must not copy, reproduce, modify, create derivative works from, transmit, distribute, publish, summarise, adapt, paraphrase or otherwise publicly display any Content without the specific written consent of a director of Citywire. This includes, but is not limited to, the use of Citywire content for any form of news aggregation service or for inclusion in services which summarise articles, the copying of any Fund manager data (career histories, profile, ratings, rankings etc) either manually or by automated means (“scraping”). Under no circumstance is Citywire content to be used in any commercial service.

2. Non-reliance 2.1 You agree that you are responsible for your own investment decisions and that you are responsible for assessing the suitability and accuracy of all information and for obtaining your own advice thereon. You recognise that any information given in this Content is not related to your particular circumstances. Circumstances vary and you should seek your own advice on the suitability to them of any investment or investment technique that may be mentioned. 2.2 The Fund manager performance analyses and ratings provided in this Content are the opinions of Citywire as at the date they are expressed and are not recommendations to purchase, hold or sell any investment or to make any investment decisions. Citywire’s opinions and analyses do not address the suitability of any investment for any specific purposes or requirements and should not be relied upon as the basis for any investment decision. 2.3 Persons who do not have professional experience in participating in unregulated collective investment schemes should not rely on material relating to such schemes. 2.4 Past performance of investments is not necessarily a guide to future performance. Prices of investments may fall as well as rise.

2.5 Persons associated with or employed by Citywire may hold positions or take positions in investments referred to in this publication. 2.6 Citywire Financial Publishers Ltd operate a policy of independence in relation to matters where the operators may have a material interest or conflict of interest.

3. Limited Warranty 3.1 Neither Citywire nor its employees assume any responsibility or liability for the accuracy or completeness of the information contained on our site. 3.2 You acknowledge and agree that any information that you receive through use of the site is provided “as is” and “as available” basis without representation or endorsement of any kind and is obtained at your own risk. 3.3 To the maximum extent permitted by law, Citywire excludes all representations, warranties, conditions or other terms, whether express or implied (by statute, common law, collaterally or otherwise) in relation to the site or otherwise in relation to any Content or Feed, including without limitation as to satisfactory quality, fitness for particular purpose, non-infringement, compatibility, accuracy, or completeness. 3.4 Notwithstanding any other provision in these Terms, nothing herein shall limit your rights as a consumer under English law.

4. Limitation of Liability To the maximum extent permitted by law, Citywire will not be liable in contract, tort (including negligence) or otherwise for any liability, damage or loss (whether direct, indirect, consequential, special or otherwise) incurred or suffered by you or any third party in connection with this Content, or in connection with the use, or results of the use of Content. Citywire does not limit liability for fraudulent misrepresentation or for death or personal injury arising from Citywire’s negligence.

5. Jurisdiction These Terms are governed by and shall be construed in accordance with the laws of England and the English courts shall have exclusive jurisdiction in the event of any dispute in connection with this Content or these Terms.