Introduction

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds, portfolios, and their managers. This time it’s the turn of the WealthSelect Managed Portfolio Service, with an in-depth profile and Q&A with portfolio manager Stuart Clark, plus supporting analysis from Citywire.

Introduction

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds, portfolios, and their managers. This time it’s the turn of the WealthSelect Managed Portfolio Service, with an in-depth profile and Q&A with portfolio manager Stuart Clark, plus supporting analysis from Citywire.

STUART

CLARK

PORTFOLIO MANAGER,

WEALTHSELECT MPS

STUART

CLARK

PORTFOLIO MANAGER,

WEALTHSELECT MPS

£5 billion in 5 years

How THE WEALTHSELECT MANAGED PORTFOLIO SERVICE became a force to be reckoned with

£5 billion in 5 years

How THE WEALTHSELECT MANAGED PORTFOLIO SERVICE became a force to be reckoned with

The last five years have been nothing if not eventful. Rising global political tension – including the advent of the Trump presidency in the US, the rise of populism in Europe and the changing political landscape in the UK – combined with the return of market volatility has kept investment managers on their toes.

Over that time, the WealthSelect Managed Portfolio Service (MPS) has grown its assets under management (AuM) from a standing start at launch in the first quarter of 2014 to £5.7bn.

That, according to portfolio manager Stuart Clark, is testament to a solid process and strong track record that has earned the range a 5 Diamond Rating by Defaqto.

“We’ve attracted the AuM, which I think gives a lot of confidence to advisers that the solution is here to stay and is suitable all round,” he said.

WealthSelect offers a fully outsourced solution for financial advisers and their clients by bringing together a selection of leading fund managers under a single suite of risk-targeted investment portfolios.

Clark and a wider team of portfolio managers and analysts start with rigorous strategic asset allocation then add value through tactical tilts and fund manager selection.

“We’re very focused on delivering the best return for a given level of risk,” said Clark. “The targeted risk is delivered through a strategic approach and we feel that’s a key competitive advantage for us.

“I fundamentally believe that strategic allocation takes care of the high level risk. If you think Chinese equities within emerging markets is the right place to be you should have that in your risk level three – your cautious risk level – as well as your risk level 10. You have less of it, of course, because it’s a more volatile asset class, but it’s still there because you’ve made that strategic call.”

How he positions the portfolios at any given time depends upon the strategic calls that underpin the success of the range.

“It’s usually a case of us thinking that market conditions are going to favour X, Y or Z manager,” he said. “For example, during recent rebalances, in September and December last year, we were starting to skew back towards the value managers and away from growth, particularly in the US and across emerging markets.”

Clark recognises the time advisers take to understand their clients’ ability and willingness to take risk – and points to the expertise he draws upon in maximising potential returns for each risk level.

WealthSelect partners with 16 fund management groups, their Global Partners – some large, some small – which collectively offer best-in-class access to a broad range of asset classes and sub-asset classes. A range of groups tend to be used for ‘the broad offering’, while specialist houses give more bespoke access to areas such as alternatives.

“A couple of years ago we decided we wanted to gain some managers who had greater alternatives exposure,” said Clark. “On top of the partners we had when we started, who did we want to add that could bring some better alternatives and improve diversification?

‘We’re very focused on delivering the best return for a given level of risk. The target risk is delivered through a strategic approach and we feel that’s a key competitive advantage for us’

STUART CLARK

“I don’t think we’ve got to the point where we’ve decided that from an investment opportunity point of view we’re interested in a sub-asset class and there’s not been something available from these 16 groups.”

Since the service launched, five new partners have been added – Allianz, Jupiter, PIMCO, Wellington and Wells Fargo. Not all run mandates for the range at any given time, but there are always ongoing discussions about new opportunities.

Further expertise has also come from takeover activity in the asset management space. “If I think back to when we started, we were working with Aberdeen and that’s now Aberdeen Standard,” said Clark. ”We were working with Threadneedle and that’s now Columbia Threadneedle. We were working with Henderson and that’s now Janus Henderson. So, we’ve gained a lot of depth through other people’s corporate activity too.”

‘It’s very rare for an entire portfolio to need to be liquidated for a new manager to be appointed… and that can save on transaction costs’

STUART CLARK

Importantly, each underlying mandate is structured as a separate managed account. This enables Clark and a team of eight dedicated research analysts to undertake greater due diligence on underlying holdings.

“We structured it this way because we felt it gave us a competitive advantage,” said Clark. “What exactly does it give us? It gives us extra disclosures on the names in the portfolio – we see day-to-day buys and sells on every single portfolio. It’s really interesting, particularly around rebalance points. We can see exactly where the managers have conviction by what they buy or don’t buy. The look-through to individual trade level also allows us to see where value has been added, and to ensure that the manager is sticking to the objective they’ve been given.”

Investing in separate managed accounts as opposed to off-the-shelf funds also makes it easier and cheaper for Clark to make changes to the portfolios.

“If we get to that point where we have greater conviction somewhere else, we don’t have to sell down every single asset,” he said. “It’s very rare for an entire portfolio to need to be liquidated for a new manager to be appointed – there might be 25% overlap [between the old and new portfolios] – and that can save on transaction costs. This is great news for investors as less cost means less drag on performance”

Another big advantage to such an approach is that it affords access to managers who are not typically available to UK retail investors.

“An example would be JP Morgan, where we wanted exposure to US large cap growth and have invested in a manager who’s based in New York,” said Clark. ”He runs a fund in the US and separate accounts; he doesn’t run anything in the European retail space.”

The approach also opens up the possibility of running bespoke accounts on some strategies that might otherwise be closed to new investors or where there may be concerns over capacity constraints. In these cases, Clark can negotiate a certain amount of access upfront.

In recent months, some of its peers have started to utilise separate accounts when running managed portfolios – validating the approach WealthSelect started out with five years ago.

“The nice thing for us is that it’s continued to grow,” added Clark. ”It’s not unwieldy, but we’ve got additional resources almost every year to help support the growth of the service.”

PORTFOLIO OVERVIEW:

a closer look at the performance

On the following pages, Citywire looks at the performance of

two WealthSelect ACTIVE MANAGED portfolios – RISK LEVEL 5 AND 10.

PORTFOLIO OVERVIEW:

A CLOSER LOOK AT THE PERFORMANCE

On the following pages, Citywire looks at the performance of two WealthSelect ACTIVE MANAGED portfolios – RISK LEVEL 5 AND 10.

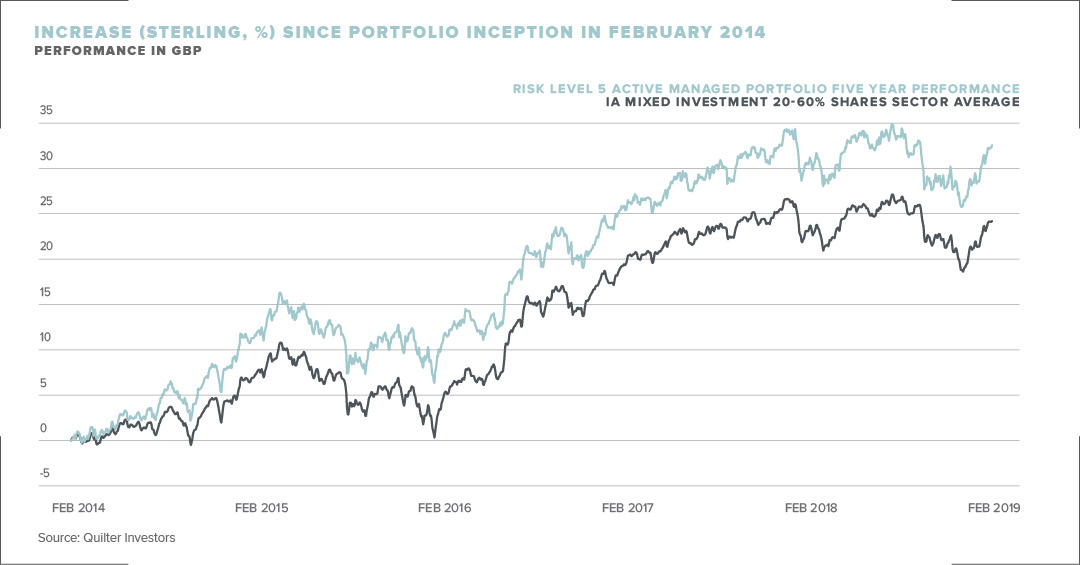

RISK LEVEL 5 ACTIVE MANAGED PORTFOLIO

The Risk Level 5 Active Managed Portfolio is quite a different animal from when it was first launched. The early days saw roughly half the portfolio invested in fixed interest and property – a figure that today is around 23.5%.

Today allocations to international equity, global specialist and alternatives funds make up around 51% of the fund versus 35% at the outset, while some 12.4% is in cash today.

As an asset allocation exercise, the changes have paid dividends. Since inception in 2014, the portfolio is up 32.56% compared with the IA Mixed Investment 20-60% Shares sector average of 24.21%. Over three years, the gap is much closer, but the portfolio still outperformed with a return of 20.49% versus the sector average of 20.31%.

While the equities sell-off in the fourth quarter of 2018 took its toll on the portfolio – losing 4.89% but still managing to beat the sector average loss of 5.42% – the recent snapback has seen it record a 1.58% one year return versus the sector average gain of 0.94%.

All data is to 24 February 2019, which is the fifth anniversary of the launch date of the WealthSelect Managed Portoflio Service.

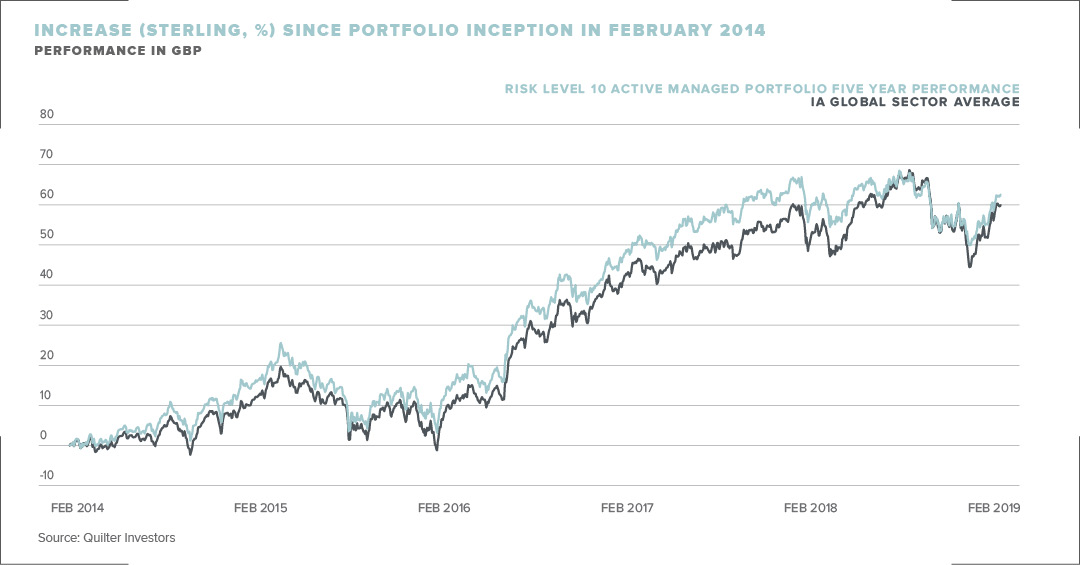

RISK LEVEL 10 ACTIVE MANAGED PORTFOLIO

With a committed 100% equity approach and a very heavy international weighting, the Risk Level 10 Active Managed Portfolio has enjoyed a robust life since inception, helped (until 2018 at least) by bullish global markets and, for the post-Brexit referendum period, by sterling’s weakness.

Notably, the portfolio only had around 5% of its holdings in UK equities when the Brexit vote happened and severely hurt domestically-exposed stocks, although this allocation has now more than doubled.

Over three and five years, the portfolio has matched the pace of the IA Global sector average. In the five years since launch on 24 February 2014, the portfolio grew 62.56% versus the sector average of 59.93% while the figures for three years showed the portfolio’s growth of 46.43% was slightly behind the sector average

of 50.41%.

Last year, and in particular the final quarter of 2018, did equity investors no favours as stock markets around the world succumbed to a wall of worries.

The Risk Level 10 Active Managed Portfolio showed a loss of 7.09% for the year versus an average loss of 5.72% for the sector, although it outperformed the peer group in the difficult second half of the year, and particularly through the market downturn in the fourth quarter.

PORTFOLIO MANAGER

HOT-SEAT

PORTFOLIO

manager

hot-seat

TELL ME ABOUT YOUR INVESTMENT PROCESS AND TEAM…

As the portfolio manager of a managed portfolio service, I think on a day-to-day basis about the holistic positioning of the portfolios – the asset allocation, the manager mix. There are eight other portfolio managers and we sit down on a weekly basis to thrash out ideas – what’s working, what’s not from a tactical asset allocation point of view. We draw on external resources too – we have 16 partner groups and part of the beauty of this is access to their macro teams. We get a lot of extra data sources by having a close relationship with them. We also have a team of eight dedicated research analysts internally who look at retail funds – it might be US-based funds, Asian-based funds or European mandates – and they do the initial and ongoing due diligence on the underlying mandates. They are more focused on whether the underlying portfolio managers are adding value against the correct benchmark. It’s not just a case of US versus S&P; it’s large cap value versus Russell 1000 Value and so on. It’s a very broad team, with each member working to support the overall process.

HOW DO YOU DECIDE WHICH MANAGERS TO USE FOR WHICH EXPOSURES?

The way we decide on managers is very much by the potential to add skills. When it comes to what I want as a portfolio manager, it might be that I say to the analyst, I need to increase my exposure to large cap value or dividends or a particular size or style bias and ask them to come to me with their best ideas. We’ll go and meet those managers together to get a feel for how they run their portfolios, whether the approach complements existing holdings and how it might feed into the overall portfolio construction. The analysts work, as most do, from a mixture of quantitative analysis and qualitative overlay to come to a conclusion on what they think will outperform going forward.

HOW MUCH CONTACT DO YOU HAVE WITH THE MANAGERS WHO RUN MANDATES FOR YOU?

Formally, the analysts have to meet with the portfolio managers every six months and write up notes. It’s very rare that we get to six months without having some kind of contact in between. We’ve got a fair few managers who are based overseas now, so we tend to have conference calls with them on a regular basis, but if they’re in London, then we’ll take that opportunity to catch up in person. We have a US Equity Small/Mid-Cap mandate run by Schroders so a good example of this was when Jenny Jones announced her retirement [in January] and [her current co-manager and successor] Bob Kaynor flew into London we took the opportunity to meet him face-to-face. It’s not on the six-monthly cycle, but it would be crazy for us not to sit down and catch up with him while he was in town.

WHAT OVERSIGHT IS THERE ON YOUR DECISION-MAKING?

We have an oversight council, which reviews everything on a quarterly basis – my asset allocation, the underlying managers. There are some non-executive directors who sit on that to help manage any conflict of interests. The outcome from each of these meetings gets reported up through the normal risk and governance cycle that you’d expect from any asset manager.

WHAT DOES WEALTHSELECT OFFER FINANCIAL ADVISERS?

It gives them a solution that lets them focus on their core skillset – financial planning – and allows us to focus on our core skillset – investment management. When I meet advisers who are running their own portfolios – and I have to say some of them are doing a fantastic job – I don’t know how they do it. I spend my days thinking about the overall portfolios and macro decisions and our team of dedicated research analysts is looking at funds all week, every week. We’re fully employed and these men and women are undertaking investment management and overlaying client suitability, risk profiling, reviews and managing their businesses on top of that. The pressures are building on advisers from a regulatory point of view to focus on other parts of their business and we’re here to offer them different propositions to help ease the strain. If they decide a multi-asset fund is the right solution for part of their client bank, we have that. If they decide a managed portfolio service is more suitable for a different part of their client bank, we can offer that too. Whatever option suits best we’ll continue to focus on doing the best job we can for the level of risk that is appropriate for each client to take.

‘Broadly speaking, the wider an investment universe, the more opportunity there is to add or subtract alpha through active decisions’

STUART CLARK

YOU OFFER BOTH ACTIVE AND PASSIVE BLEND OPTIONS. WHAT IS THE SPLIT BETWEEN THESE AND HAVE YOU SEEN A SHIFT?

There are two investment approaches – active and passive blend – and eight risk levels, so 16 options in total. These can be held across four different tax wrappers. Around 85% of assets are currently in the active range and 15% in the passive blend. We’ve seen an increased preference for the active approach over the past five years, which I think is quite interesting because it runs counter to the trend in the market. Compared to some of our competitors, I don’t think there’s such a large degree of pricing differential between our active and passive blend, so maybe that’s why people look at the active offering as being incredible value for money. If you can get it for 20 basis points more, why wouldn’t you go active, particularly at this stage in the cycle?

DO YOU FIND THERE’S MORE ABILITY TO ADD ALPHA IN CERTAIN MARKETS?

It’s definitely true that it’s tougher to add value in certain markets, so US large cap is incredibly tough. Broadly speaking, the wider an investment universe, the more opportunity there is to add or subtract alpha through active decisions. In emerging markets, you can throw in country risk, sector risk and currency risk – there are lots of different levers for managers in these markets to pull. These can be positive or negative, but our due diligence helps us to steer towards the better managers. We’re not looking for every manager to be firing on all cylinders at the same time. We want to mix large cap, mid cap, value, growth and quality biases at all times. Depending on where we think the opportunities lie, we’ll overemphasise or de-emphasise certain managers.

HOW ARE YOU MANAGING RISK IN THE CURRENT ENVIRONMENT?

We have some exposure to UK government bonds. This is the only area in which we have gone completely passive, using a Gilt Index mandate managed by BlackRock, even in active portfolios. We also have Nick Maroutsos of Kapstream, part of Janus Henderson, running an absolute return income mandate for us out of Newport Beach, California. We’ve got a lot of confidence in him. A couple of our guys met him three years ago, but he wasn’t available to us because the company wasn’t one of the partners. Kapstream was a subsidiary of Janus Capital Group and its merger with Henderson Global Investors changed that. When the stars align like that, it’s fantastic. It gives us an opportunity for cash to work in a lower risk way. Happy days.

CITYWIRE INVESTMENT WARNING

This communication is by Citywire Financial Publishers Ltd (“Citywire”) and is provided in Citywire’s capacity as financial journalists for general information and news purposes only. It is not (and is not intended to be) any form of advice, recommendation, representation, endorsement or arrangement by Citywire or an invitation to invest or an offer to buy, sell, underwrite or subscribe for any particular investment. In particular, the information provided will not address your particular circumstances, objectives and attitude towards risk.

Any opinions expressed by Citywire or its staff do not constitute a personal recommendation to you to buy, sell, underwrite or subscribe for any particular investment and should not be relied upon when making (or refraining from making) any investment decisions. In particular, the information and opinions provided by Citywire do not take into account your personal circumstances, objectives and attitude towards risk.

Citywire uses information obtained primarily from sources believed to be reliable (such as company reports and financial reporting services) however Citywire cannot guarantee the accuracy of information provided, or that the information will be up-to-date or free from errors. Investors and prospective investors should not rely on any information or data provided by Citywire but should satisfy themselves of the accuracy and timeliness of any information or data before engaging in any investment activity. If in doubt about a particular investment decision an investor should consult a regulated investment advisor who specialises in that particular sector.

Information includes but is not restricted to any video, article or guide content created or provided by Citywire.

For your information we would like to draw your attention to the following general investment warnings:

The price of shares and investments and the income associated with them can go down as well as up, and investors may not get back the amount they invested. The spread between the bid and offer prices of securities can be significant in volatile market conditions, especially for smaller companies. Realisation of small investments may be relatively costly. Some investments are not suitable for unsophisticated or non-professional investors. Appropriate independent advice should be obtained before making any such decision to buy, sell, underwrite or subscribe for any investment and should take into account your circumstances and attitude to risk.

Past performance is not necessarily a guide to future performance. Citywire Financial Publishers Ltd. is authorised and regulated by the Financial Conduct Authority (no: 222178).

TERMS OF SERVICE

Citywire Source is owned and operated by Citywire Financial Publishers Ltd (“Citywire”). Citywire is a company registered in England and Wales (company number 3828440), with registered office at 1st Floor, 87 Vauxhall Walk, London, SE11 5HJ and is authorised and regulated by the Financial Conduct Authority (no: 222178) to provide investment advice and is bound by its rules.

1. Intellectual Property Rights 1.1 We are the owner or licensee of all copyright, trademarks and other intellectual property rights in and to these works (including all information, data and graphics in them) (collectively referred to as “Content”). You acknowledge and agree that all copyright, trademarks and other intellectual property rights in this Content shall remain at all times vested in Citywire and /or its licensors. 1.2 This Content is protected by copyright laws and treaties around the world. All such rights are reserved. Images and videos used on our websites are © iStockphoto, Alamy, Thinkstock, Topfoto, Getty Images or Rex Features (among others). For credit information relating to specific images where not stated, please contact picturedesk@citywire.co.uk. 1.3 You must not copy, reproduce, modify, create derivative works from, transmit, distribute, publish, summarise, adapt, paraphrase or otherwise publicly display any Content without the specific written consent of a director of Citywire. This includes, but is not limited to, the use of Citywire content for any form of news aggregation service or for inclusion in services which summarise articles, the copying of any Fund manager data (career histories, profile, ratings, rankings etc) either manually or by automated means (“scraping”). Under no circumstance is Citywire content to be used in any commercial service.

2. Non-reliance 2.1 You agree that you are responsible for your own investment decisions and that you are responsible for assessing the suitability and accuracy of all information and for obtaining your own advice thereon. You recognise that any information given in this Content is not related to your particular circumstances. Circumstances vary and you should seek your own advice on the suitability to them of any investment or investment technique that may be mentioned. 2.2 The Fund manager performance analyses and ratings provided in this Content are the opinions of Citywire as at the date they are expressed and are not recommendations to purchase, hold or sell any investment or to make any investment decisions. Citywire’s opinions and analyses do not address the suitability of any investment for any specific purposes or requirements and should not be relied upon as the basis for any investment decision. 2.3 Persons who do not have professional experience in participating in unregulated collective investment schemes should not rely on material relating to such schemes. 2.4 Past performance of investments is not necessarily a guide to future performance. Prices of investments may fall as well as rise.

2.5 Persons associated with or employed by Citywire may hold positions or take positions in investments referred to in this publication. 2.6 Citywire Financial Publishers Ltd operate a policy of independence in relation to matters where the operators may have a material interest or conflict of interest.

3. Limited Warranty 3.1 Neither Citywire nor its employees assume any responsibility or liability for the accuracy or completeness of the information contained on our site. 3.2 You acknowledge and agree that any information that you receive through use of the site is provided “as is” and “as available” basis without representation or endorsement of any kind and is obtained at your own risk. 3.3 To the maximum extent permitted by law, Citywire excludes all representations, warranties, conditions or other terms, whether express or implied (by statute, common law, collaterally or otherwise) in relation to the site or otherwise in relation to any Content or Feed, including without limitation as to satisfactory quality, fitness for particular purpose, non-infringement, compatibility, accuracy, or completeness. 3.4 Notwithstanding any other provision in these Terms, nothing herein shall limit your rights as a consumer under English law.

4. Limitation of Liability To the maximum extent permitted by law, Citywire will not be liable in contract, tort (including negligence) or otherwise for any liability, damage or loss (whether direct, indirect, consequential, special or otherwise) incurred or suffered by you or any third party in connection with this Content, or in connection with the use, or results of the use of Content. Citywire does not limit liability for fraudulent misrepresentation or for death or personal injury arising from Citywire’s negligence.

5. Jurisdiction These Terms are governed by and shall be construed in accordance with the laws of England and the English courts shall have exclusive jurisdiction in the event of any dispute in connection with this Content or these Terms.