For investment professionals only

The Long and

the Short of It

Presenting Threadneedle

UK Extended Alpha Fund

Sponsored by

DECEMBER 2019

INTRODUCTION

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds and their managers. This time, Columbia Threadneedle Investments present the Threadneedle UK Extended Alpha Fund, with a profile and Q&A with portfolio manager Chris Kinder, plus supporting analysis from Citywire.

INTRODUCTION

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds and their managers. This time, Columbia Threadneedle Investments present the Threadneedle UK Extended Alpha Fund, with a profile and Q&A with portfolio manager Chris Kinder, plus supporting analysis from Citywire.

MORE SKILLS, BROADER OPPORTUNITY SET:

THREADNEEDLE UK

Extended Alpha Fund

MORE SKILLS, BROADER OPPORTUNITY SET: THREADNEEDLE UK

Extended Alpha Fund

hile many will acknowledge the valuation opportunities in the UK equity market following the EU referendum, the Threadneedle UK Extended Alpha Fund can exploit them better than most.

Chris Kinder, who has just entered his tenth year of running the fund, has more levers at his disposal than many UK equity fund managers, because he is able to take both long and short positions.

While many will acknowledge the valuation opportunities in the UK equity market following the EU referendum, the Threadneedle UK Extended Alpha Fund can exploit them better than most.

Chris Kinder, who has just entered his tenth year of running the fund, has more levers at his disposal than many UK equity fund managers, because he is able to take both long and short positions.

With a process and philosophy focused on bottom-up stock picking, Kinder works within a very experienced UK Equity team responsible for running over £21 billion AUM* in UK listed companies. ‘We do a lot of work on companies across the FTSE All-Share yet only choose to own a smaller number of conviction stocks. This leaves a large number of companies that we choose not to own and this product enables me to add alpha by identifying those that are mispriced.’

‘We have exposures on the long side that are UK domestic – there are certain incredibly healthy franchises that are able to grow,’ he says.

‘There are businesses that are taking market share and businesses that are losing market share, but because they’re all tarred with a Brexit brush, they’re all undervalued.

‘You can have a better-quality asset at the same price as a really low-quality asset. That’s a source of alpha. It all comes down to bottom-up analysis and stock picking.’

One-quarter of Kinder’s long book is in consumer services stocks and a similar weight is in consumer goods companies. When picking domestic-facing stocks Kinder likes those that do well in a challenging economy, discount retailers being one example.

‘We are seeing people in the UK moving to discounting,’ he says. ‘In a tough economy, you want to shop with the lowest cost provider. So, there are always opportunities. Even in a weak economy there are going to be strong companies.’

A big component of his stock-picking process addresses the issue of whether a share is undervalued or not; a lost art of sorts lately. In particular, he looks to buy companies that are of better-than-average quality but are trading at lower-than-average valuations.

Kinder can make relative value plays among stocks of similar quality – buying shares in an undervalued company and short selling those in a comparatively overvalued one, although he points out that not all his short positions are relative value.

‘If you have two assets of similar quality, with one being cheaply valued and one being expensively valued, that looks like an arbitrage opportunity and is a source of alpha that is available to this fund,’ he says.

That’s just one way of realising excess performance, however. Merger and acquisition (M&A) activity is yet another way in which Kinder has been delivering returns to investors.

‘Another way in which value can be realised is when a third party comes and buys a share off you at a higher price than it was trading at in the stock market,’ he says. ‘That’s a real theme, because we’re seeing massive amounts of M&A.’

Three of his long positions, which typically number around 50, have been taken over during 2019, hot on the heels of two the previous year. And Kinder has a keen eye trained on other likely takeover targets.

‘It’s something that we’ve got a good track record of doing [finding them]’, he says. ‘If I’m getting three takeouts every year, that’s really helpful – when they get taken out, they go at 30% to 40% premium.

*SOURCE: Columbia Threadneedle Investments as at 31 October.

‘If you have two assets of similar quality, with one being cheaply valued and one being expensively valued, that looks like an arbitrage opportunity and is a source of alpha that is available to this fund’

CHRIS KINDER

‘We would never invest in a company solely on the prospect of being taken out, but intellectually, if you think it’s a theme and you think there’s a lot of money in the theme, you’re going to look a little bit harder than you might have done historically.’

Meanwhile, company bosses’ caution on capital expenditure amid a subdued global economy and political uncertainty frees up cash to be spent on acquisitions and share buybacks. While these represent an important source of support for share prices on one hand, they also serve to shrink equity markets on the other.

‘It’s good in that we have an opportunity set to make money,’ says Kinder. ‘The negative side of it, of course, in the medium term is that if it continues, we’re going to be hollowing out our market.’

The fund is firmly in the first quartile of the IA UK All Companies Sector in the past year, returning 10.7% net of fees, compared to the FTSE All-Share Index, which has returned 6.8% (at October 2019).*

The fourth quarter of 2018 aside, it has done relatively well in drawdown periods, too, when the types of stocks it tends to short – more expensive and lower quality – typically lead the market lower, netting Kinder a handsome profit.

A case in point is 2011 when the US suffered its first-ever credit rating downgrade and fears of contagion of the European sovereign debt crisis sent markets plummeting. Threadneedle UK Extended Alpha lost just 2% during that year, against a UK market decline

of 3.5%.*

Moreover, Kinder points to the low level of volatility with which the fund has achieved its returns. ‘One of the best features of it, to use some technical jargon, is the information ratio since I took over. Over this period it has provided disproportionate amounts of return for the risk it takes.’

Despite its strong short-term performance in falling markets, it remains a relatively small fund at less than £160 million – much to Kinder’s frustration.

‘It’s got to be the complexity – I think people struggle with what bucket to put it in and people struggle with the concept of shorting. People might say that it’s neither fish nor fowl. In our view it’s designed to sit within a UK allocation rather than an absolute return bucket.’

The central premise of the fund, however, is that it enables investors to stay invested throughout the cycle. And as we enter a year of heightened uncertainty – for politics, the economy and risk assets like equities – that might prove to be its biggest selling point.

*SOURCE: Morningstar as at 31 October, fund performance net of fees. Past performance is not a guide to future performance.

Performance

Review:

Performance

Review:

Threadneedle UK extended alpha: Performance REview

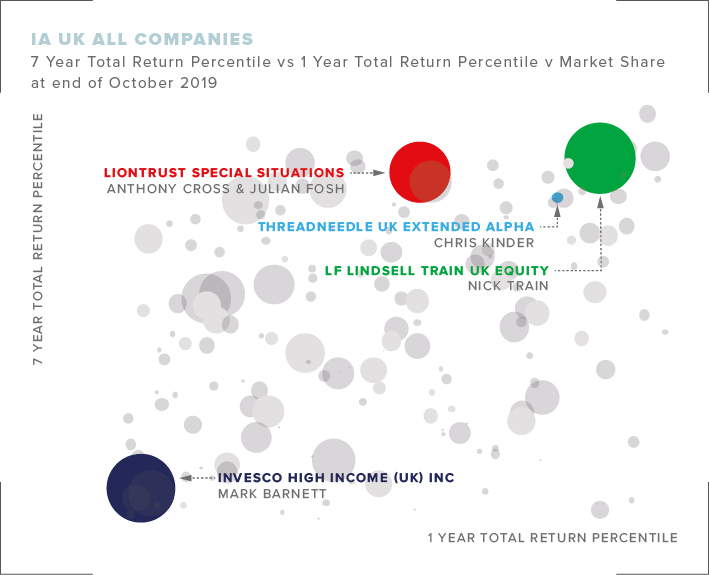

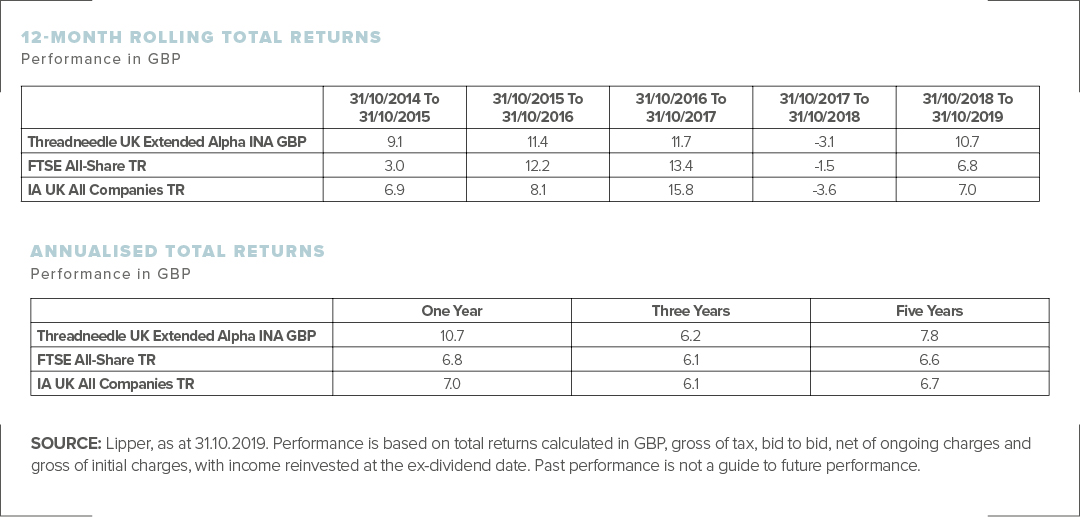

The Threadneedle UK Extended Alpha Fund sits in the top quartile of the IA UK All Companies peer group over both one and seven years on a total return basis.

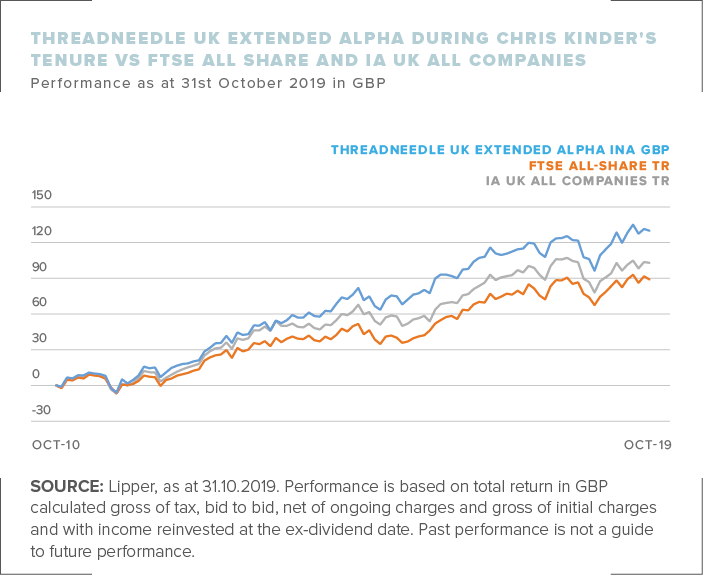

SOURCE: Lipper, as at 31.10.2019. Risk-adjusted percentiles are calculated in GBP gross of tax, bid to bid, net of ongoing charges and gross of initial charges and with income reinvested at the ex-dividend date. Peer group rankings are based on funds in the IA UK All Companies sector. Market share data based on total assets under management in the IA UK All Companies sector.

Over Chris Kinder’s nine-year tenure the Threadneedle UK Extended Alpha portfolio has handsomely outperformed both the bechmark and the average fund. Generating returns of 130%, compared with 89% for the FTSE All-Share and 103% for the average fund in the category. In addition the portfolio is ahead of the benchmark and the average fund over seven- five- three- and one-year time frames.

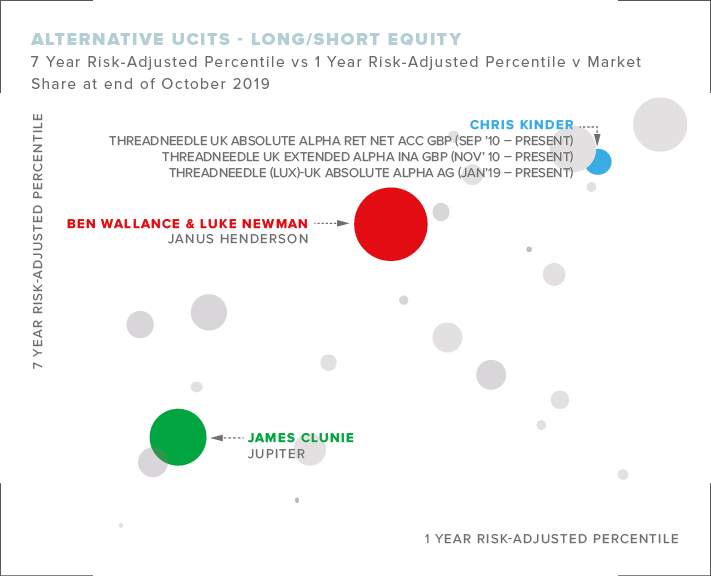

Performance review of chris kinder in Alternative UCITS – Long/Short Equity

Chris Kinder looks good on a risk-adjusted basis over both seven and one year time periods in the peer group. This includes both the Threadneedle UK Absolute Alpha and Threadneedle UK Extended Alpha Funds he currently runs, and can be seen by his position in the upper right hand quandrant of the bubble chart. Over the past seven years he has generated second decile risk-adjusted returns, while over the past year he is top quartile. Kinder is ahead of market share leaders from Janus Henderson and Jupiter over both time frames. He has also achieved this while exposing investors to less risk than the peer group average, with his maximum drawdown over the seven years standing at just 9.2%, which places him the second quartile over the period.

SOURCE: Citywire Discovery, as at 31.10.2019. Risk-adjusted percentiles are calculated in GBP gross of tax, bid to bid, net of ongoing charges and gross of initial charges and with income reinvested at the ex-dividend date. Peer group rankings are based on managers tracked by Citywire in the UK. Market share data based on total assets under management by managers tracked by Citywire in the UK.

FUND MANAGER HOT-SEAT:

CHRIS KINDER

FUND MANAGER HOT-SEAT:

CHRIS KINDER

TALK ME THROUGH YOUR STOCK SELECTION – IS IT BOTTOM UP?

Absolutely. Everything on the long side is there because we like it. The way I appraise equities is a function of the quality of the company and the valuation of the company. What I do is buy better-than-average quality at lower-than-average valuation, and on the short side we are essentially looking at over-loved, over-priced and generally lower quality than perceived and deteriorating. The devil is in the business; it’s in the detail. The strength and scale of our team is a big help, of course. We are a relatively large UK team with a lot of experience in this market through market cycles. Our proximity to companies and the fact that we do really robust fundamental work is why the fund is performing well, not because I like Brexit or I don’t like Brexit, or I don’t like Donald Trump or I don’t like China. The portfolio isn’t set up on the basis of UK bad, US good, China bad, Japan good – it’s [all about] the stocks.

BASED ON YOUR STOCK-PICKING, WHERE ARE YOU FINDING THE BEST INVESTMENT IDEAS JUST NOW?

Many of the long holdings have been in the portfolio for years. So, it’s not a case of what’s my best idea today. I don’t ever want to make the portfolio dependent on one thing. The biases in the portfolio currently are underweight on large cap, capital intensive, slow growth, mature companies. That would be a feature. We don’t really own big oil, big mining, big banks. We have quite a lot of well-diversified exposure to global travel and leisure stocks and corporate services on the long side. We’ve got a couple of housebuilders. It’s all done on a stock-by-stock basis. We own staple assets and there’s quite a big exposure to the consumer. From the top-down, if you looked at the portfolio, you’d think it was underweight resources, generally neutral on financials with a preference for insurance over banks and overweight consumer spending and corporate spending.

WHAT BEARING HAS POLITICAL UNCERTAINTY HAD ON YOUR POSITIONING?

Probably a quarter of the portfolio is exposed to UK domestics. We’re not in the camp at all that Brexit or the election has made UK domestic assets uninvestable. What we want is the highest quality cohort of UK assets that will thrive in whatever economic environment comes to us. We don’t own them because we think the UK’s going to get better and [prime minister] Boris [Johnson] is going to win and it’s all going to be great. That’s not the base case; it’s more that the assets that we own can take market share – they’ve got strong balance sheets, they’re good businesses.

SO STRONG BALANCE SHEETS – WHAT ELSE DO YOU LOOK FOR IN A QUALITY COMPANY?

There’s a focus on return on capital. There’s a focus on business positioning. It’s about quality, not growth. A very high top-line growth rate is not particularly interesting to me, because it often can’t last. It’s about returns, compounding growth rates, asset quality and market position. We use Porter’s Five Forces analysis, then overlay a view on the balance sheet. Is the business well-funded? Does the business generate cash? If it generates cash, does it deploy it effectively? We are cautious on M&A-led strategies. We prefer organic growth to inorganic. Another feature of quality would be the management and if it’s a team we know well. Are they consistent in their strategy and execution? What is their track record? Do we have a good level of engagement with them? Are they remunerated appropriately? Do they behave with integrity when we see them? We look for quality on a financial metric and on a governance metric as well.

IS IT FAIR TO SAY THE PORTFOLIO IS QUITE DEFENSIVE?

It’s balanced. It’s skewed up the market cap scale in that the big capital allocation is probably between £1 billion and £40 billion. We’re certainly light on the mega caps. We don’t do small cap at all. So, we’re in the small large cap, big mid cap space. It’s diversified. It has a quality bias, if that’s what you’re referring to as defensiveness. That is deliberate. Our primary role is to identify good companies that can grow over time, then to make sure we don’t overpay for them. There’s a value filter to it as well. Relative to other competing funds and the market, it’s got a really powerful value tilt. The longs are cheapish, but the shorts are very expensive. One of the real features over the past nine months or so is how overvalued certain cohorts of assets have become. It is incumbent upon us to look into those areas for short ideas.

HOW CHEAP IS THE UK? A LOT HAS BEEN MADE OF ITS CHEAPNESS, BUT DO YOU BUY INTO THAT?

There are reasons that the UK market in aggregate terms should be cheaper than other markets. Firstly, it’s got a lower natural growth rate because so much of the UK market is tied up in heavily capital-intensive industries. Think BP and Shell. Think banking, which is naturally low growth, naturally low return, naturally higher yielding. The UK market’s always going to have a higher dividend yield and we’re going to have a lower growth rate – there should be some discount for that. Having said that, there is underlying cheapness across the board. There are perfectly good companies in the UK that are trading much cheaper than international competitors. Then you’ve got this quarter of the market that’s UK domestic that is trading more cheaply because of Brexit. I would say it is cheap, but it’s subtly cheap. There’s definitely a cohort of the market that isn’t cheap. One area is the defensives. That’s where we want to be careful – we don’t own too much and is there an opportunity for shorting? If Brexit is better than people think and the world economy is better than people think, maybe people have overpaid for their bond proxies.

STOCK MARKETS HAVE HAD A PRETTY EASY RIDE SINCE YOU STARTED RUNNING THE FUND IN 2010. IS THE BEST YET TO COME FOR A LONG/SHORT STRATEGY LIKE YOURS?

It is a directional fund. Given that it’s a fund that has the ability to go up to 150% long and 50% short, I knew it would be difficult in the first few years because the concept was very hot in the run-up to the global financial crisis. A lot of people believed in these types of strategy because they are intellectually sound, but then they were executed really poorly by the cohorts of people who had gathered assets in the run-up to the crisis. Therefore, there was a lot of cynicism about them. The risk of course, when you’re shorting and writing open-ended liabilities, is that you can lose more than all your money, which is quite a scary concept. I know that because I’ve been doing it for nine years and I did seven years of hedge funds before that. There’s a skillset to managing short positions that is not necessarily well observed in many of the more traditional fund management houses. I’ve always felt that time is my friend with this product. Nearly 10 years in and we’re pleased to see our approach is standing the test of time for our clients.’

To find out more contact your local Columbia Threadneedle Investments representative at columbiathreadneedle.co.uk/contactus

KEY RISKS

The value of investments can fall as well as rise and investors might not get back the sum originally invested. Where investments are in assets that are denominated in multiple currencies, or currencies other than your own, changes in exchange rates may affect the value of the investments. The Fund may enter into financial transactions with selected counterparties. Any financial difficulties arising at these counterparties could significantly affect the availability and the value of Fund assets. The Fund’s assets may sometimes be difficult to value objectively and the actual value may not be recognised until assets are sold. Leverage occurs when economic exposure through derivatives is greater than the amount invested. Such exposure, and the use of short selling techniques, may lead to the Fund suffering losses in excess of the amount it initially invested. The Fund may invest materially in derivatives. A relatively small change in the value of the underlying investment may have a much larger positive or negative impact on the value of the derivative.

Important Information

For use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients). Past performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Your capital is at risk. The mention of any specific shares or bonds should not be taken as a recommendation to deal. Columbia Threadneedle Investments does not give any investment advice. If you are in doubt about the suitability of any investment, you should speak to your financial adviser. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed.

Threadneedle Specialist Investment Funds ICVC (“TSIF”) is an open-ended investment company structured as an umbrella company, incorporated in England and Wales, authorised and regulated in the UK by the Financial Conduct Authority (FCA) as a UCITS scheme. Subscriptions to a Fund may only be made on the basis of the current Prospectus and the Key Investor Information Document, as well as the latest annual or interim reports and the applicable terms & conditions. Please refer to the `Risk Factors’ section of the Prospectus for all risks applicable to investing in any fund and specifically this Fund. The above documents are available in English, French, German, Portuguese, Italian, Spanish and Dutch (no Dutch Prospectus) and can be obtained free of charge on request from: Client Services department PO Box 10033, Chelmsford, Essex CM99 2AL. Issued by Threadneedle Investment Services Limited. Registered in England and Wales, Registered No. 3701768, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle groups of companies.

This communication is by Citywire Financial Publishers Ltd (“Citywire”) and is provided in Citywire’s capacity as financial journalists for general information and news purposes only. It is not (and is not intended to be) any form of advice, recommendation, representation, endorsement or arrangement by Citywire or an invitation to invest or an offer to buy, sell, underwrite or subscribe for any particular investment. In particular, the information provided will not address your particular circumstances, objectives and attitude towards risk.

Any opinions expressed by Citywire or its staff do not constitute a personal recommendation to you to buy, sell, underwrite or subscribe for any particular investment and should not be relied upon when making (or refraining from making) any investment decisions. In particular, the information and opinions provided by Citywire do not take into account your personal circumstances, objectives and attitude towards risk. Citywire uses information obtained primarily from sources believed to be reliable (such as company reports and financial reporting services) however Citywire cannot guarantee the accuracy of information provided, or that the information will be up-to-date or free from errors. Investors and prospective investors should not rely on any information or data provided by Citywire but should satisfy themselves of the accuracy and timeliness of any information or data before engaging in any investment activity. If in doubt about a particular investment decision an investor should consult a regulated investment advisor who specialises in that particular sector. Information includes but is not restricted to any video, article or guide content created or provided by Citywire.

For your information we would like to draw your attention to the following general investment warnings: The price of shares and investments and the income associated with them can go down as well as up, and investors may not get back the amount they invested. The spread between the bid and offer prices of securities can be significant in volatile market conditions, especially for smaller companies. Realisation of small investments may be relatively costly. Some investments are not suitable for unsophisticated or non-professional investors. Appropriate independent advice should be obtained before making any such decision to buy, sell, underwrite or subscribe for any investment and should take into account your circumstances and attitude to risk. Past performance is not necessarily a guide to future performance. Citywire Financial Publishers Ltd. is authorised and regulated by the Financial Conduct Authority (no: 222178).

Citywire Source is owned and operated by Citywire Financial Publishers Ltd (“Citywire”). Citywire is a company registered in England and Wales (company number 3828440), with registered office at 1st Floor, 87 Vauxhall Walk, London, SE11 5HJ and is authorised and regulated by the Financial Conduct Authority (no: 222178) to provide investment advice and is bound by its rules.

1. Intellectual Property Rights 1.1 We are the owner or licensee of all copyright, trademarks and other intellectual property rights in and to these works (including all information, data and graphics in them) (collectively referred to as “Content”). You acknowledge and agree that all copyright, trademarks and other intellectual property rights in this Content shall remain at all times vested in Citywire and /or its licensors. 1.2 This Content is protected by copyright laws and treaties around the world. All such rights are reserved. Images and videos used on our websites are © iStockphoto, Alamy, Thinkstock, Topfoto, Getty Images or Rex Features (among others). For credit information relating to specific images where not stated, please contact picturedesk@citywire.co.uk. 1.3 You must not copy, reproduce, modify, create derivative works from, transmit, distribute, publish, summarise, adapt, paraphrase or otherwise publicly display any Content without the specific written consent of a director of Citywire. This includes, but is not limited to, the use of Citywire content for any form of news aggregation service or for inclusion in services which summarise articles, the copying of any Fund manager data (career histories, profile, ratings, rankings etc) either manually or by automated means (“scraping”). Under no circumstance is Citywire content to be used in any commercial service.

2. Non-reliance 2.1 You agree that you are responsible for your own investment decisions and that you are responsible for assessing the suitability and accuracy of all information and for obtaining your own advice thereon. You recognise that any information given in this Content is not related to your particular circumstances. Circumstances vary and you should seek your own advice on the suitability to them of any investment or investment technique that may be mentioned. 2.2 The Fund manager performance analyses and ratings provided in this Content are the opinions of Citywire as at the date they are expressed and are not recommendations to purchase, hold or sell any investment or to make any investment decisions. Citywire’s opinions and analyses do not address the suitability of any investment for any specific purposes or requirements and should not be relied upon as the basis for any investment decision. 2.3 Persons who do not have professional experience in participating in unregulated collective investment schemes should not rely on material relating to such schemes. 2.4 Past performance of investments is not necessarily a guide to future performance. Prices of investments may fall as well as rise. 2.5 Persons associated with or employed by Citywire may hold positions or take positions in investments referred to in this publication. 2.6 Citywire Financial Publishers Ltd operate a policy of independence in relation to matters where the operators may have a material interest or conflict of interest.

3. Limited Warranty 3.1 Neither Citywire nor its employees assume any responsibility or liability for the accuracy or completeness of the information contained on our site. 3.2 You acknowledge and agree that any information that you receive through use of the site is provided “as is” and “as available” basis without representation or endorsement of any kind and is obtained at your own risk. 3.3 To the maximum extent permitted by law, Citywire excludes all representations, warranties, conditions or other terms, whether express or implied (by statute, common law, collaterally or otherwise) in relation to the site or otherwise in relation to any Content or Feed, including without limitation as to satisfactory quality, fitness for particular purpose, non-infringement, compatibility, accuracy, or completeness. 3.4 Notwithstanding any other provision in these Terms, nothing herein shall limit your rights as a consumer under English law.

4. Limitation of Liability To the maximum extent permitted by law, Citywire will not be liable in contract, tort (including negligence) or otherwise for any liability, damage or loss (whether direct, indirect, consequential, special or otherwise) incurred or suffered by you or any third party in connection with this Content, or in connection with the use, or results of the use of Content. Citywire does not limit liability for fraudulent misrepresentation or for death or personal injury arising from Citywire’s negligence.

5. Jurisdiction These Terms are governed by and shall be construed in accordance with the laws of England and the English courts shall have exclusive jurisdiction in the event of any dispute in connection with this Content or these Terms.