INTRODUCTION

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds and their managers. This time, Columbia Threadneedle Investments present the Threadneedle Global Focus Fund, with an in-depth profile and Q&A with manager David Dudding, plus supporting analysis from Citywire.

INTRODUCTION

Welcome to another edition of SOURCE, a publication that shines the spotlight on selected funds and their managers. This time, Columbia Threadneedle Investments present the Threadneedle Global Focus Fund, with an in-depth profile and Q&A with manager David Dudding, plus supporting analysis from Citywire.

A GLOBAL QUALITY GROWTH STAR:

THREADNEEDLE GLOBAL FOCUS FUND

n a year of gloomy world economics, why has this particular global growth fund shone so bright? Manager David Dudding explains how his strategy’s premium-only stock selection saw it steal the spotlight.

Stocks have climbed the wall of worry this year, with the MSCI ACWI index confounding its critics to post its best first-half performance in more than 20 years. That’s not to say that slowing global growth, trade wars, Chinese currency devaluation and the possibility of a hard Brexit haven’t all impacted markets at various times. Yet, throughout it all, it’s paid to hold your nerve and stay invested, particularly as central banks around the world look to become more accommodative.

Stocks have climbed the wall of worry this year, with the MSCI ACWI index confounding its critics to post its best first-half performance in more than 20 years. That’s not to say that slowing global growth, trade wars, Chinese currency devaluation and the possibility of a hard Brexit haven’t all impacted markets at various times. Yet, throughout it all, it’s paid to hold your nerve and stay invested, particularly as central banks around the world look to become more accommodative.

‘I think investing in the world’s premier companies always makes sense,’ explained Dudding, a Senior Portfolio Manager at Columbia Threadneedle and manager of the outperforming Threadneedle Global Focus Fund.

The Fund was launched in 2018 as a result of strong demand for a UK vehicle that mirrors the highly successful Threadneedle (Lux) Global Focus Fund, which has been running since 2013. The OEIC fund is a concentrated global quality growth portfolio, with Dudding scouring a wide universe to give investors access to around 30 to 50 of the best opportunities, unconstrained by regional boundaries. For those wanting to stay invested without making large macro or regional calls, the fund makes one’s equity allocation for their clients easy, with strong upside capture and downside risk management.

‘The fund is designed to be a onestop quality equity solution,’ he said. ‘As bottom-up stockpickers, we want to uncover the best sources of alpha for our clients. These are high-conviction growing companies – the best in the world in our mind. As “go-anywhere” investment managers, meanwhile, we have exposures to developed and emerging markets.’

Major Indian banks and a UK-based data analytics provider complement the usual US tech and healthcare stalwarts. No matter the location, Dudding stressed that it’s the fund’s obsession with quality and competitiveness that informs the portfolio and sets it apart from its rivals.

‘Geographic allocation is no longer as important in such a globalised economy,’ he said. ‘There are Chinese tech firms listed in New York, for instance. Many of the biggest names in the UK, be it banks or oil companies, have little to do with the British economy and get most of their revenues from overseas.

‘For us, it’s the stock selection that drives the regional weightings. What’s crucial, what is central to everything we do, is that search for high-quality names growing sustainably faster than the market,’ he added.

How does Dudding, who lived in Hong Kong before joining Columbia Threadneedle as a research analyst 20 years ago, define ‘quality’ then?

Traditional metrics such as high returns on capital, low levels of financial leverage, less cyclical business models and strong earnings stability all play a major part in their investment process.

‘But, actually,’ he added, ‘what we’re really focussed on is “competitive advantage”.

‘We want to see evidence of a wide economic moat,’ he continued. ‘Cost advantage, efficient scale, switching costs, network effect and intangible assets, such as patents and barriers to entry, are important sources of a wide moat and strong competitive advantage. And they usually indicate whether a company is able to generate – and improve – returns on capital over time.’

CHOOSING WISELY

While that’s led Dudding and his team down paths as diverse as Indian financials and Hong Kong life insurers, their bias towards quality and competitive advantage does mean they tend to avoid certain sectors. Cyclical firms such as resources, oil and gas, and car companies are given a wide berth. Industrials, for the most part, and developed market banks are also shunned, a move that’s proven wise as banks in the US, Europe and Japan continue to struggle amid lower rates and flattening yield curves.

‘I wouldn’t say we rule anything out,’ Dudding said. ‘But the focus on quality, durability and competitiveness does lead us to focus on capital-light companies overall. They’re going to hold up better over the cycle we think. Generally, we tend to have more in the way of healthcare, software and consumer staples – although we’re underweight consumer staples right now, which is something that sets us apart from our competitors.’

The focus on quality also means that the fund tends to better tolerate downturns, too. In the sharp sell-off in Q4 2018, for example, the fund actually outperformed the wider market which contributed to it outshining its benchmark, the MSCI ACWI index, over the year*.

‘Sometimes there’s an element of luck, but we maintain a very strong emphasis on downside protection,’ Dudding conceded. ‘In Q4, tech was hit hard, but our exposure to the sector held up relatively well. Our exposure to certain other sectors also helped and we finished the quarter up 2%. And one of the things about investing in the very best companies is that they tend to fare better over time. They might seem expensive, and we will sell if they’ve run up too much. But I’d say that a lot of the companies we’re invested in should grow their earnings, even in a recession and one of the things about investing in the very best companies is that they tend to fare better over time. They might seem expensive, and we will sell if they’ve run up too much.’

*SOURCE: Columbia Threadneedle / Factset Threadneedle Global Focus Fund, gross of fees as at 31.12.2018. Please refer to the fund factsheet for full performance history. Past performance is not a guide to future performance.

‘Certainly, one of the best things about working for a global asset manager is being able to draw on a range of regional, industry and local experts within our firm,’ he said.

He added: ‘We have offices in 17 countries, while the equities team is comprised of global, regional and even country specific strategies, across the entire market cap spectrum. We also have dozens of analysts constantly doing research and meeting company management teams. I’m always talking to my colleagues, and being a “go-anywhere” global fund, there’s not many companies, trends or risks that we’re not made aware of when there’s an opportunity or challenge.’

‘It’s a tried and tested strategy that continues to work over time,’ he said. ‘I have a lot of my own money – my family’s money – invested in the fund. It’s a great way to get exposed to what we believe are the best businesses in the world over the next few years. There will always be concerns and risks across the globe, I understand that. But it generally pays to stay the course.’

GLOBAL EQUITY

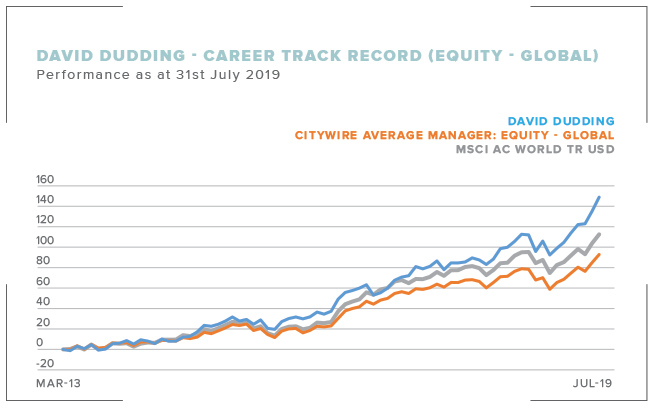

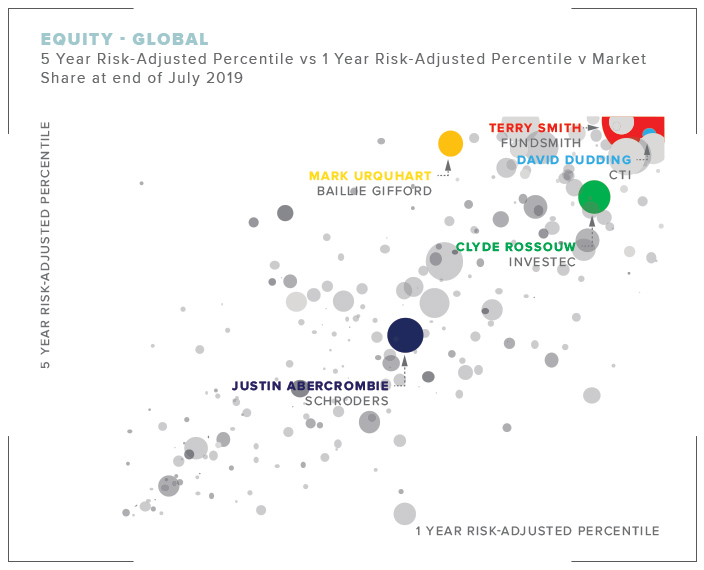

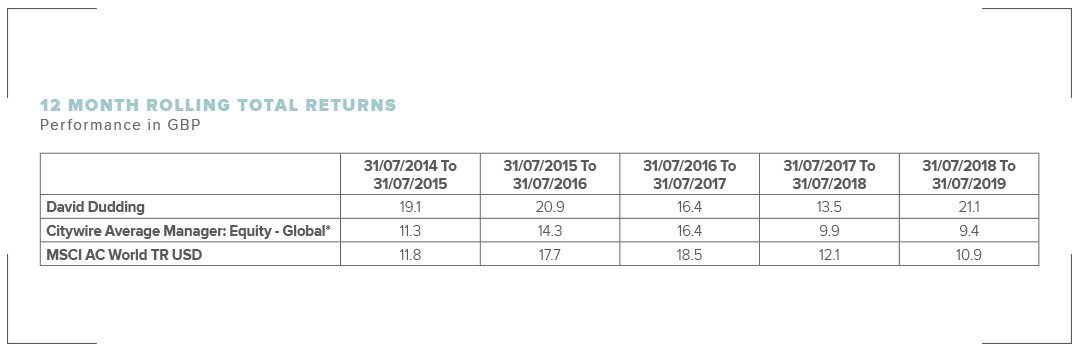

David Dudding is far from a one trick pony and has used the experience he has gathered in European equities to good effect in global equities. This has been one of the hardest categories to add value in during the post credit crisis period, with less than 20% achieving it over the past five years. Yet Dudding has not only outperformed the average manager, but the benchmark as well since his track record began in this sector in April 2013.

SOURCE: Citywire Discovery. Past performance is not a guide to future performance.Performance as at 31.07.2019. Performance data is based on David Dudding’s track record within the sector, calculated on a total return basis, gross of initial charges, net of ongoing charges and gross of taxes.

David has delivered a consistently high level of risk-adjusted returns over both one and five years (as can be seen by his position in the upper right hand quadrant of the graphic). Even outperforming the sector’s market share leaders in Terry Smith (Fundsmith) and Nick Train (Lindsell Train) over the past twelve months. A period which includes Q4 2018’s steep market correction.

SOURCE: Citywire Discovery, as at 31.07.2019. Total Return percentiles are calculated in GBP gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Peer group rankings are based on managers tracked by Citywire in the UK. Market share data based on total assets under management by managers tracked by Citywire in the UK. Past performance is not a guide to future performance.

SOURCE: Citywire Discovery, as at 31.07.2019. Total Return percentiles are calculated in GBP gross of tax, bid to bid, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Peer group rankings are based on managers tracked by Citywire in the UK. Market share data based on total assets under management by managers tracked by Citywire in the UK.

Past performance is not a guide to future performance.

* UK registered shareclasses only

DAVID DUDDING

DAVID DUDDING

We sit down with Columbia Threadneedle’s Global Focus Fund manager to hear about why global equities shouldn’t just be a short-term investment theme, especially in an increasingly globalised industry.

WHY DO GLOBAL EQUITIES MAKE SENSE RIGHT NOW?

I don’t think global equities make sense right now per se – I think they always make sense! If you think that, historically, equities are one of, if not the bestperforming, asset class, then I think it makes sense to have exposure to equities and let those returns compound over time. There are always going to be doubts and worries, but major bear markets such as 2008 happen very rarely.

Which then begs the question: where do you want to be invested? You could make an argument for many different regions and allocate accordingly. The US continues to outperform the rest of the world with fantastic technology like cloud computing, for instance. But is this sustainable given the level of outperformance in recent years has been unprecedented? Does it still command an overweight? At the same time, we know that emerging markets will enjoy superior growth, and they have better debt and demographic profiles, leading to themes like wealth creation and the rise of the Asian consumer. So there can be many benefits to having exposure to emerging markets, even if they’ve struggled in the past decade. And Japan, Europe and the UK still have some great names worth investing in if you can find them.

There’s always a lot happening in the world, especially now with the rise of emerging markets and technological innovation. Investing in a single quality global fund allows you to tap into those strong secular opportunities across a range of industries and geographies, rather than having to try and time your own allocating or macro calls.

HOW HAVE GLOBAL EQUITIES CHANGED OVER TIME?

I think global equity as an asset class has changed drastically. In particular, the old way of categorising stocks into regions and geographies is breaking down as corporations become more global.

If you look at the FTSE 100, for instance, the biggest names, be it Shell, BP, Glaxo or HSBC, they do the majority of their business overseas and often in emerging markets. So, they’re not that correlated to the UK economy at all. Similarly, global conglomerates might be listed in Hong Kong, Tokyo or New York – and we’ve seen a large number of Asian tech companies list in the US recently, for example. Or US tech companies may be ‘American’, but then firms such as Apple derive so much of their earnings from overseas. There’s no neat way to categorise equities geographically anymore.

In terms of revenue, we are actually overweight in these markets. You really have to take a proper bottom-up, granular view of where these companies are making their money. For that reason, it shouldn’t be a concern that we have such a large overweight to US companies and a relatively small allocation to emerging countries on paper. It balances out.

CAN YOU DESCRIBE THE PORTFOLIO? WHAT DOES IT LOOK LIKE?

The Threadneedle Global Focus Fund is a best-ideas portfolio of the highest-quality growth names. With around 30 to 50 at any one time, it’s quite concentrated, but it’s usually very diversified and doesn’t have a reliance on a particular sector or geography to drive performance. There’s emerging market financials, UK analytics companies, a Japanese automation firm, and the usual US healthcare and tech giants. It’s a great mix that tends to do well over the cycle because we’re not piled into a few countries or ideas, and there’s a range of different investment themes and sources of alpha.

The one thing the stocks have in common, is that they are very high-quality names, with high returns on capital, generally low levels of leverage, a great business model and a strong competitive advantage. That last part is especially important to us. It’s easy to simply look at metrics such as return on equity or price to sales, but we want to know that these companies have longevity and can continue to expand their ‘moat’ and maintain their competitive advantage. That’s particularly so given the fast-paced nature of global commerce these days, where disruption and innovation are hallmarks.

WHAT HAPPENS IF COMPANIES AREN’T PERFORMING AS YOU EXPECT OR HAVE RUN UP A LOT? ARE YOU JUDICIOUS IN DIVESTING OR SELLING SOME OF YOUR STAKE?

Yes, because selling is just as important a part of portfolio management as buying is, particularly when it comes to risk management. While all of our holdings are high conviction buys, if the stock isn’t performing as expected, we’ll revisit our thesis. And if the situation has changed or we realise we’ve got something wrong and they’re losing their competitive advantage, then of course we’ll sell. That’s just a great habit to have – you can’t afford to be stubborn.

‘IT’S REALLY A TEAM EFFORT OVERALL, WHERE I’M ABLE TO CALL ON DOZENS OF ANALYSTS AND INDUSTRY OR REGIONAL SPECIALISTS THROUGHOUT THE GLOBE’

We will also sell if a company has run up too much or looks expensive. Generally, we like to let our winners run, but we will sell if it looks expensive and take a breather to book profits, at least for the time being.

But the idea to buy or sell a certain name isn’t something I do alone. It’s really a team effort, where I’m able to call on dozens of analysts and industry or regional specialists throughout the globe in order to find the best opportunities – no matter location, cap size, or industry. So you really are getting access to the world’s best companies.

KEY RISKS

Investment risk: The value of investments can fall as well as rise and investors might not get back the sum originally invested. Currency risk: Where investments are in assets that are denominated in multiple currencies, or currencies other than your own, changes in exchange rates may affect the value of the investments. Effect of Portfolio Concentration: The Fund has a concentrated portfolio (holds a limited number of investments and/or has a restricted investment universe) and if one or more of these investments declines or is otherwise affected, it may have a pronounced effect on the fund’s value. Derivatives for EPM / Hedging: The investment policy of the fund allows it to invest in derivatives for the purposes of reducing risk or minimising the cost of transactions. Volatility risk: The fund may exhibit significant price volatility.

Important Information

For use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients). Past performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Your capital is at risk. The mention of any specific shares or bonds should not be taken as a recommendation to deal. Columbia Threadneedle Investments does not give any investment advice. If you are in doubt about the suitability of any investment, you should speak to your financial adviser. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed.

For Threadneedle Global Focus Fund (OEIC): Threadneedle Specialist Investment Funds ICVC (“TSIF”) is an open-ended investment company structured as an umbrella company, incorporated in England and Wales, authorised and regulated in the UK by the Financial Conduct Authority (FCA) as a UCITS scheme. Subscriptions to a Fund may only be made on the basis of the current Prospectus and the Key Investor Information Document, as well as the latest annual or interim reports and the applicable terms & conditions. Please refer to the `Risk Factors’ section of the Prospectus for all risks applicable to investing in any fund and specifically this Fund. The above documents are available in English, French, German, Portuguese, Italian, Spanish and Dutch (no Dutch Prospectus) and can be obtained free of charge on request from: Client Services department PO Box 10033, Chelmsford, Essex CM99 2AL. Issued by Threadneedle Investment Services Limited. Registered in England and Wales, Registered No. 3701768, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority.

For the Threadneedle (Lux) Global Focus Fund: Threadneedle (Lux) is an investment company with variable capital (Société d’investissement à capital variable, or “SICAV”) formed under the laws of the Grand Duchy of Luxembourg. The SICAV issues, redeems and exchanges shares of different classes. The management company of the SICAV is Threadneedle Management Luxembourg S.A, which is advised by Threadneedle Asset Management Ltd. and/or selected sub-advisors.

Subscriptions to a Fund may only be made on the basis of the current Prospectus and the Key Investor Information Document, as well as the latest annual or interim reports and the applicable terms & conditions. Please refer to the `Risk Factors’ section of the Prospectus for all risks applicable to investing in any fund and specifically this Fund. Documents other than KIIDs are available in English, French, German, Portuguese, Italian, Spanish and Dutch (no Dutch Prospectus). KIIDs are available in local languages. Documents can be obtained free of charge on request by writing to the management company at 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg, from International Financial Data Services (Luxembourg) S.A. at 47, avenue John F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg, from www.columbiathreadneedle.com and/or from – in the UK from JPMorgan Worldwide Securities Services, 60 Victoria Embankment, London EC4Y 0JP. Threadneedle Management Luxembourg S.A. Registered with the Registre de Commerce et des Societes (Luxembourg), Registered No. B 110242 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg. In the UK issued by Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle groups of companies.

This communication is by Citywire Financial Publishers Ltd (“Citywire”) and is provided in Citywire’s capacity as financial journalists for general information and news purposes only. It is not (and is not intended to be) any form of advice, recommendation, representation, endorsement or arrangement by Citywire or an invitation to invest or an offer to buy, sell, underwrite or subscribe for any particular investment. In particular, the information provided will not address your particular circumstances, objectives and attitude towards risk.

Any opinions expressed by Citywire or its staff do not constitute a personal recommendation to you to buy, sell, underwrite or subscribe for any particular investment and should not be relied upon when making (or refraining from making) any investment decisions. In particular, the information and opinions provided by Citywire do not take into account your personal circumstances, objectives and attitude towards risk. Citywire uses information obtained primarily from sources believed to be reliable (such as company reports and financial reporting services) however Citywire cannot guarantee the accuracy of information provided, or that the information will be up-to-date or free from errors. Investors and prospective investors should not rely on any information or data provided by Citywire but should satisfy themselves of the accuracy and timeliness of any information or data before engaging in any investment activity. If in doubt about a particular investment decision an investor should consult a regulated investment advisor who specialises in that particular sector. Information includes but is not restricted to any video, article or guide content created or provided by Citywire.

For your information we would like to draw your attention to the following general investment warnings: The price of shares and investments and the income associated with them can go down as well as up, and investors may not get back the amount they invested. The spread between the bid and offer prices of securities can be significant in volatile market conditions, especially for smaller companies. Realisation of small investments may be relatively costly. Some investments are not suitable for unsophisticated or non-professional investors. Appropriate independent advice should be obtained before making any such decision to buy, sell, underwrite or subscribe for any investment and should take into account your circumstances and attitude to risk. Past performance is not necessarily a guide to future performance. Citywire Financial Publishers Ltd. is authorised and regulated by the Financial Conduct Authority (no: 222178).

Citywire Source is owned and operated by Citywire Financial Publishers Ltd (“Citywire”). Citywire is a company registered in England and Wales (company number 3828440), with registered office at 1st Floor, 87 Vauxhall Walk, London, SE11 5HJ and is authorised and regulated by the Financial Conduct Authority (no: 222178) to provide investment advice and is bound by its rules.

1. Intellectual Property Rights 1.1 We are the owner or licensee of all copyright, trademarks and other intellectual property rights in and to these works (including all information, data and graphics in them) (collectively referred to as “Content”). You acknowledge and agree that all copyright, trademarks and other intellectual property rights in this Content shall remain at all times vested in Citywire and /or its licensors. 1.2 This Content is protected by copyright laws and treaties around the world. All such rights are reserved. Images and videos used on our websites are © iStockphoto, Alamy, Thinkstock, Topfoto, Getty Images or Rex Features (among others). For credit information relating to specific images where not stated, please contact picturedesk@citywire.co.uk. 1.3 You must not copy, reproduce, modify, create derivative works from, transmit, distribute, publish, summarise, adapt, paraphrase or otherwise publicly display any Content without the specific written consent of a director of Citywire. This includes, but is not limited to, the use of Citywire content for any form of news aggregation service or for inclusion in services which summarise articles, the copying of any Fund manager data (career histories, profile, ratings, rankings etc) either manually or by automated means (“scraping”). Under no circumstance is Citywire content to be used in any commercial service.

2. Non-reliance 2.1 You agree that you are responsible for your own investment decisions and that you are responsible for assessing the suitability and accuracy of all information and for obtaining your own advice thereon. You recognise that any information given in this Content is not related to your particular circumstances. Circumstances vary and you should seek your own advice on the suitability to them of any investment or investment technique that may be mentioned. 2.2 The Fund manager performance analyses and ratings provided in this Content are the opinions of Citywire as at the date they are expressed and are not recommendations to purchase, hold or sell any investment or to make any investment decisions. Citywire’s opinions and analyses do not address the suitability of any investment for any specific purposes or requirements and should not be relied upon as the basis for any investment decision. 2.3 Persons who do not have professional experience in participating in unregulated collective investment schemes should not rely on material relating to such schemes. 2.4 Past performance of investments is not necessarily a guide to future performance. Prices of investments may fall as well as rise. 2.5 Persons associated with or employed by Citywire may hold positions or take positions in investments referred to in this publication. 2.6 Citywire Financial Publishers Ltd operate a policy of independence in relation to matters where the operators may have a material interest or conflict of interest.

3. Limited Warranty 3.1 Neither Citywire nor its employees assume any responsibility or liability for the accuracy or completeness of the information contained on our site. 3.2 You acknowledge and agree that any information that you receive through use of the site is provided “as is” and “as available” basis without representation or endorsement of any kind and is obtained at your own risk. 3.3 To the maximum extent permitted by law, Citywire excludes all representations, warranties, conditions or other terms, whether express or implied (by statute, common law, collaterally or otherwise) in relation to the site or otherwise in relation to any Content or Feed, including without limitation as to satisfactory quality, fitness for particular purpose, non-infringement, compatibility, accuracy, or completeness. 3.4 Notwithstanding any other provision in these Terms, nothing herein shall limit your rights as a consumer under English law.

4. Limitation of Liability To the maximum extent permitted by law, Citywire will not be liable in contract, tort (including negligence) or otherwise for any liability, damage or loss (whether direct, indirect, consequential, special or otherwise) incurred or suffered by you or any third party in connection with this Content, or in connection with the use, or results of the use of Content. Citywire does not limit liability for fraudulent misrepresentation or for death or personal injury arising from Citywire’s negligence.

5. Jurisdiction These Terms are governed by and shall be construed in accordance with the laws of England and the English courts shall have exclusive jurisdiction in the event of any dispute in connection with this Content or these Terms.